Foreign exchange (FX) – the largest market globally in terms of daily volume – has been the bread and butter for decades for many banks. Most of this volume comes from institutional trading, but the corporate part contributes significantly when it comes to margin revenues.

Next to that, corporate FX remains a typical flow product and therefore ‘door opening’ product for relationship managers and treasury advisors. The market for FX products has seen quite some developments for corporate small and medium-sized business (SMB) users. During the last few years, banks have been seeking ways to increase their FX competitiveness beyond pricing. The question arises: what strategies can banks implement for improving their single-bank FX propositions?

Banks have seen a lot of competition entering the market for corporate FX since the early days of this millennium. In 2000 both 360T and FXall entered the market and became very successful for large corporate flow, especially after 2010. Many different brokers have also entered the market at that time. During the last few years, numerous Fintech companies have taken a slice of the pie for FX. A lot of them combine this with payments.

These ‘new’ players have much to offer to SMBs: quick and easy onboarding, virtual accounts, sharp pricing, easy connectivity and most of the time nice online journeys. However, there are also things to overcome for these parties: having a narrower product offering, requiring companies to deposit collateral sometimes, not always having real bank accounts, a much lower credit rating than most banks and no (substantial) front office for consultations and support.

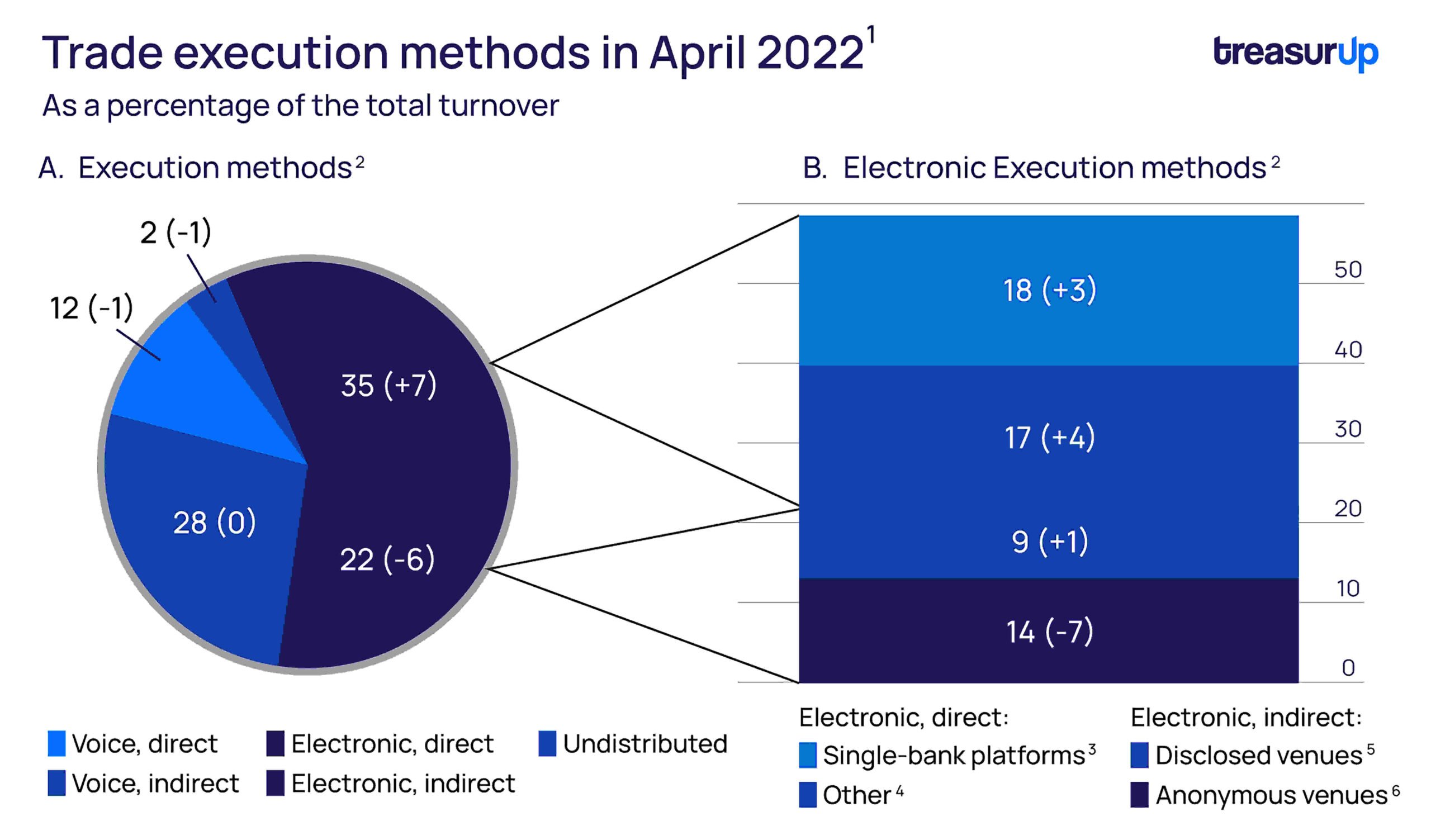

When looking at the channels being used – see the BIS graph below – one can conclude that single bank platforms remain an important factor in day-to-day FX trading. It also shows that still, depending on the region, a lot of FX trading is done by phone. This is not just the case for institutional flow. TreasurUp has learned that for example in Latin America, certain parts of Asia, Africa and Europe many FX Sales people in dealing rooms are still picking up the phone for plain vanilla spot or forward transactions.

In brackets: change in percentage points since the 2019 Triennial. Direct: trades not intermediated by a third party. Indirect: trades intermediated by a third party – either a voice broker or a third-party electronic platform. Single-bank trading systems (eg Barclays BARX, Citi Velocity, Deutsche Bank Autobahn, UBS Neo).Other direct electronic trading systems (eg direct electronic price streams). Multi-bank dealing systems that facilitate trading on a disclosed basis or that allow for liquidity partitioning using customised tags (eg 360T, EBS Direct, Currenex FXTrades, Fastmatch, FXall OrderBook, Hotspot Link). Electronic trading platforms geared to the non-disclosed inter-dealer market (eg EBS Market, Hotspot FX ECN, Reuters (Refinitiv) Matching).

Banks where online FX has fully matured are promoting their next-generation FX, for example, based on AI or smart analytics engines in specialist magazines, websites and social media. Even though these new technologies are very interesting to further optimize FX trading, they are usually geared towards institutional and rather professional corporate users with dedicated treasury departments. On the SMB client side, on the other hand, there seems to be upside potential just around the corner.

Whether it would be through clients trading more because of better hedging or taking (back) some flow from the non-bank competition, banks have good playing cards to begin with. Banks have the balance sheet, the payments accounts, the specialized and trained front office staff, the IT power and above all: the total set of financial solutions that SMBs require.

The seemingly small distance to the payments journeys of SMBs, as well as the Cash Management/Transaction Banking for the Markets team, remain exception cases. Not many banks have integrated the worlds of FX and payments fully in the sense that they can provide client-specific spot rates to payments now and in the future or on the back of outstanding forward contracts. Pre-validations and payments trackings are also not common in most offerings.

Many SMBs at some point introduce treasury policies and approval workflow for important financial processes like payments and hedging. Online Transaction banking propositions should properly cater for that. That includes offering easy-to-use configurations of these processes as they are targeted at SMBs. Next to that online platforms should allow for sufficient flexibility based on the principle of 80/20: 80% of the bank’s SMBs should be able to configure their particular way of working as one of the default settings that the bank is offering.

The early adopter SMBs would want to fully automate their repetitive operational financial processes like payments and hedging. For that, fetching the appropriate data from the SMB’s bookkeeping/ERP platform is crucial. It goes without saying that the SMB would first need to be convinced by the bank that the value offered with these automation services supports the efforts to approve and establish a connection between the company and the bank. And this connection should be easy, fast and seamless from the SMB’s perspective.

Most journeys start with insights into current cash positions: per entity, per bank, per account, and per currency. The logical next step is to help a company with proper forecasting. Most online Commercial Banking offerings do not include cash flow forecasting and if they do it is close to retail forecasting: extrapolating account balances.

The next big thing would be to link the bank’s Term deposits and credits & loans products to these forecasts in order to facilitate solutions for upcoming cash shortages and to better manage their excess liquidity.

Single-bank FX propositions will not result easily in large top-line growths when made more sophisticated in terms of complex AI, complex products and lots of bells and whistles. Instead, banks could earn more on single bank FX if it reflects the SMB journeys a lot better. That means embedding FX in logical total journeys, for example with payments, trade finance and forecasting. This also requires the front office to educate clients about market practice treasury processes in combination with the bank’s integrated online offering.

In short, most banks have substantial upside potential for FX business. For professional-institutional and large corporate markets – this may lean on further sophistication of FX products and markets. For the SMB markets, the upside mainly lies in cross-functions with closely related products and business lines like Cash Management but also automation and full workflow support. A good starting point for that might be bank product lines working more intensely together in order to better reflect how SMBs work.

Stay updated on the latest in online Commercial Banking, and subscribe to our monthly LinkedIn Newsletter, “TreasurUpdate for Banks.”