Trade Credit Insurance (TCI) is often seen as a product only provided by insurers. Even though Trade Credit Insurance plays a vital role in global trade, in banking activities like financing corporates and reducing capital requirements, there is little integration of Trade Credit Insurance into the bank’s- and their clients’ workflow.

Trade Credit Insurance (TCI) protects B2B companies against the non-payment of supplied goods or services. When a company buys such insurance, it usually is a ‘whole turnover’ policy. But also a ‘key buyer’ and ‘single risk, single invoice’ insurance is possible.

‘Trade Credit Insurance (TCI) covers 60% of the risk of international trade.’

Trade Credit Insurance insures only B2B transactions. After the insurance policy is issued, the Trade Credit Insurance company will analyse the creditworthiness and financial stability of all of the policyholder’s customers (‘buyers’) and assign them a specific credit limit. This is the amount they will indemnify if a buyer fails to pay. Disputes are not insured, however they will be covered once the situation has been cleared. It may well be the case that trade credit insurers will provide only partial insurance cover or even refuse to issue a specific credit limit (leading to a supplier not being able to get insurance on one of his clients).

Trade Credit Insurance is not only used for domestic trade: it is also widely used in export markets with countries and customers where a company has no experience yet or where the political environment creates challenges for doing business.

Trade Credit Insurance (TCI) is used less by SMBs than large(r) companies due to costs, the ability to understand the insurance policies as well as the product itself. An integrated digital Trade Credit Insurance offering can reach smaller companies easier by providing speed, direct policy generation and onboarding. In many cases, SMBs do not know about the ability for Trade Credit Insurance and if they do, it takes weeks to get to a proper and understandable policy.

There is a lot to gain by bringing the Trade Credit Insurance product into the (online) banking offering; for the SMB, the bank as well as the insurer:

Direct relation to underlying data from ERP systems (orders, invoices, buyers, turnover) will reduce manual work, improve operational efficiency and moreover increase policy compliance as well as reduce the risk of double insurance.

A simple referral partnership between banks and Trade Credit Insurance insurers not only keeps the sales channels separate. It also misses out on many operational benefits: reducing administration and lead times for financing requests, automation of insurance policies, collection processes, claim processes, and compliance improvement.

Digital-offered Trade Credit Insurance (TCI) by banks can provide easy-to-understand, direct insurance. With an integrated approach, the bank has real-time, full and accurate information as well as confidence that their financed clients are acting in compliance with policy conditions.

If and when the credit insurance policy serves bank financing and the bank is assigned to the insurance policy as a ‘loss payee,’ claims will be paid out directly to the bank that finances.

Trade Credit Insurance does not replace credit management nor replace credit practices but instead enhances the job of a professional assessing trade credit risks. The ultimate goal of Trade Credit Insurance is not only to indemnify losses incurred from defaulting buyers but moreover providing companies with the support and knowledge they need to avoid them from the outset. The key to this has the right information to make well-informed credit decisions and therefore avoid or minimize losses. By having this information, companies also have the confidence to make more strategic decisions to profitably grow their business.

If a loss should occur, companies need to file a claim with supporting documents (order forms, bill of lading, etc.). The trade credit insurer will then pay the company the claim benefit. If and when the credit insurance policy serves bank financing and the bank is assigned to the insurance policy as a ‘loss payee,’ claims will be paid out directly to the bank that finances.

The best trade credit insurers invest heavily in the development of proprietary credit- and financial information, have risk analysts on the payroll, as well as ‘risk underwriters’ (looking to industries as well as countries) in many geographic locations in order to have the closest physical presence possible to companies. Trade credit insurers will also analyse payment information from their customers’ (‘policyholders’) buyers to identify early financial signals. Risk analysts study and evaluate information on individual buyers and use that information to partially or fully approve or decline credit limit requests from policyholders. The analysis of this information allows companies to decide whether to extend credit to their customers (‘buyers’) and if so at what level. More importantly, it enables companies to avoid losses through the close monitoring of their customers. Nowadays, many trade credit insurers have a high level of automated decisions. Some of the largest credit insurers reach a level of an automated risk decision of 70%+.

After taking out the insurance policy, the policyholder may request insurance coverage for a (new) client with which they would like to do business. The insurer will assess the risk and the level of coverage they are willing to grant and will either approve the credit limit, approve partially or decline to issue insurance coverage. Similarly, policyholders may also request to increase the credit limit on a specific buyer, for example in the case of seasonality.

The information is constantly updated and reviewed by the credit insurer. They do this by gathering information about buyers from various sources, including visits to the buyers, public records and information supplied by other policyholders that sell to the same buyer, annual accounts, etc.

Trade credit insurers manage their total value of credit limits ongoing: they usually issue ‘cancellable’ credit limits (limits that can be reduced or cancelled at any time if deemed necessary for economic, financial or political reasons). When a company is experiencing financial difficulty, the insurer notifies all clients who sell to that buyer of the increased risk and establishes a risk-action plan to mitigate and avoid loss: most of the time outstanding individual limits will be reduced or cancelled. New applications for cover will be declined. This will lead to a significant reduction (or full cancellation!) of the total value at risk of the credit insurer. In this case, clients (policyholders) have a ‘commercial’ problem: should I continue to supply by taking the full risk myself or not? Usually, it will also not be possible to find ‘credit cover’ elsewhere.

After a company has purchased Trade Credit Insurance (unlike with other types of insurance), the relationship becomes very dynamic and usually intense: credit limits need to be aligned with the ordering book of the supplier, and credit limits may be refused or granted in part by the insurer. Also, the company must comply with all policy conditions to qualify for a valid claim if an invoice remains unpaid.

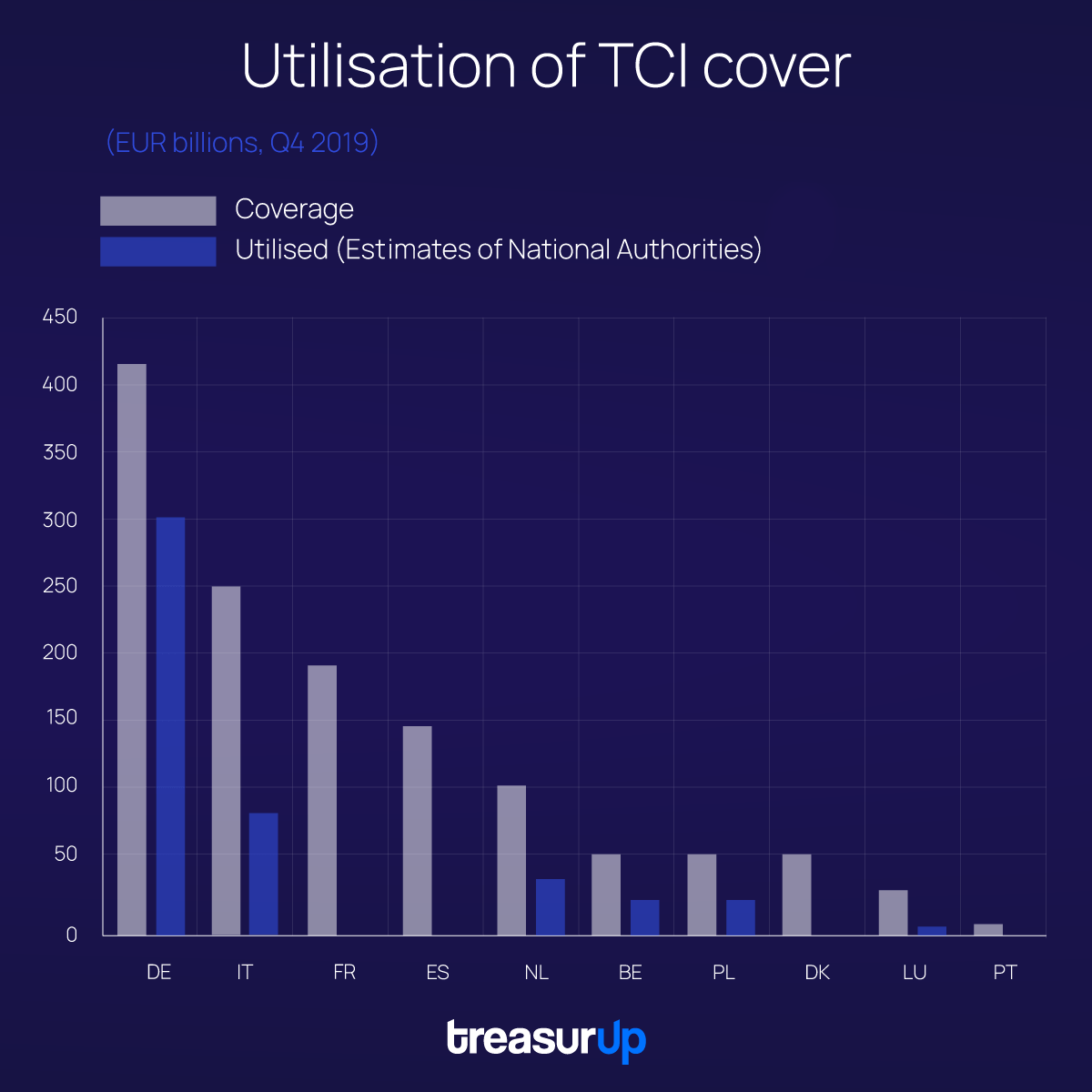

The trade credit market covers 60% of international trade, but this varies significantly per sector, geography and company size also play a role. Penetration is higher in Europe but still varies per country.

Source: Calculations based on information provided in

the European Commission Competition Policy Case Database

Africa, which has the largest benefit in schemes assisting in smooth trade, has a very small portion of the global Trade Credit Insurance market.

‘The Trade Credit Insurance (TCI) market is estimated to be around USD 11 Billion and growing to over USD 18 Billion by 2027.‘

The trend that SMBs move into a global market is an opportunity for banks and trade credit insurers to provide the tools to their clients: easy, quick and safe cross-border financial instruments.

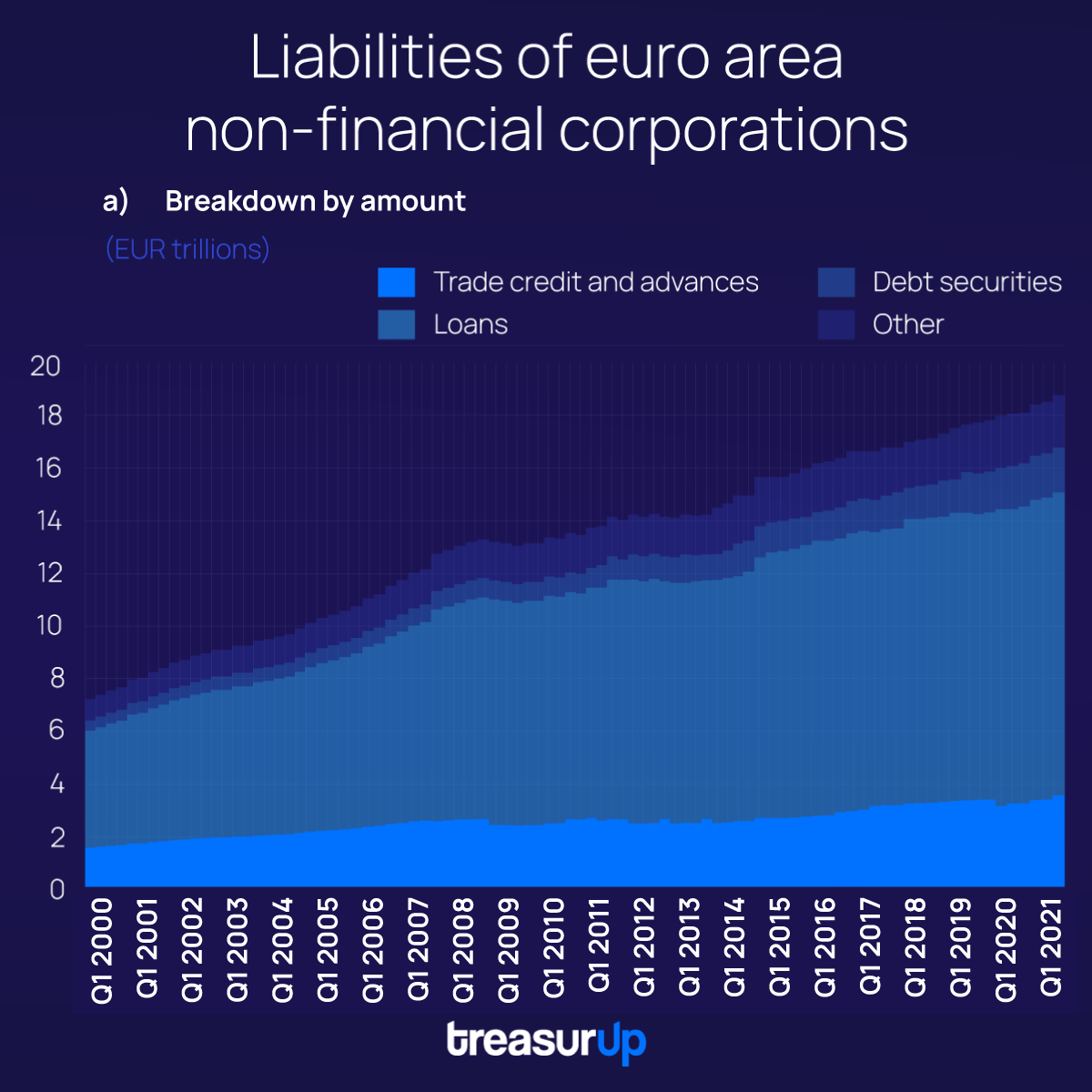

Source: ECB, own calculations

1. Professional Clients and Lower Risk Throughout the Chain

Lower credit risk and more room for payment term extensions facilitate (international) growth. A credit management toolkit will help professionalise companies. Next to that, easy onboarding and easy applying for credit limits for counterparties will make the business a lot easier for many SMB companies. Trade Credit Insurance also facilitates better credit and loan processes if their SMB clients have proper risk management in place. Also, Trade Credit Insurance (TCI) allows a company to set limits without buyer involvement.

2. Link to Financing

In financing, the quality of the assets is a logical qualitative measurement for credit. Banks frequently require Trade Credit Insurance (TCI) for financing to improve the quality of the assets and/or to provide a higher lending ratio. The current model is often that banks require this but do not actively get involved in the insurance side. This results in a suboptimal scenario where, especially for SMBs, they are often not serviced or prioritised by specialised Trade Credit Insurance brokers. And when they are serviced the lead time for financing is increased by a separate insurance track with all common hassles such as onboarding, test limits and costs. The right level of involvement of a bank speeds up its own financing process. The bank also integrates a very important compliance element: assurance that the client has actually bought the insurance policy.

3. Relation Between All Parties, Bank, Client and Insurer

In most Trade Credit Insurance user cases the operational relation is primarily between the insurer and the policyholder (a bank client). The dynamics of credit insurance with changes in limits and also policy compliance are kept between these 2 parties. The bank assumes the client’s AR is fully insured as the bank is dependent on manual processes outside the insurer-client relationship. Processes like reporting insured buyers, limits, overdue invoices, and claims filing are elements that banks take for granted. By integrating these worlds, the whole chain optimises.

4. Risk Weighted Assets

Basel III and IV regulations have driven the minimum reserve capital a bank needs to hold upwards. Basel dictates the minimum capital reserve at 10.5% of its risk-weighted assets plus the countercyclical capital buffer and leverage ratio requirement. Many banks use proprietary models for the capital buffer, but more often than not Trade Credit Insurance can be used to drive the risk-weighted assets part of the model into a more favorable outcome. In this case, the bank is usually the insurance taker. With Basel IV, the purpose is to harmonise the playing field and harmonise bank calculations. This will most likely also impact the borrowing cost for corporates. Even though most larger corporates without a credit rating will probably see the highest hit, smaller corporates and banks can integrate Trade Credit Insurance into the financing to partially compensate for an expensive and difficult-to-obtain credit rating and through that have a visible credit track record.

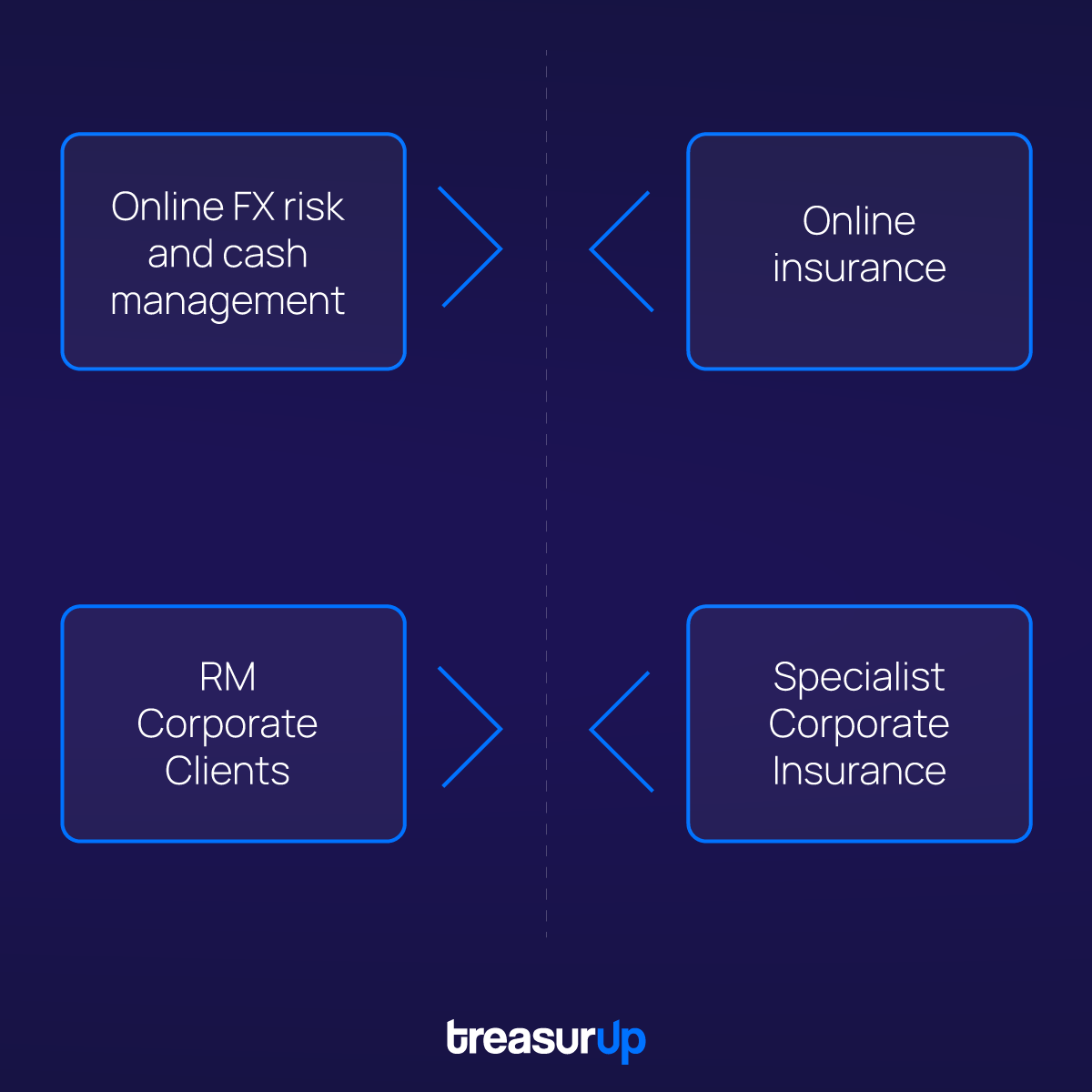

5. Innovation

Having Trade Credit Insurance integrated into a Commercial Banking online proposition with STP policy generation engine, as well as digitised subsequent processes will be a new thing in the market. This is a typical example of breaking the silos for the benefit of SMB clients. In this case, the whole chain benefits.

Gerard van Kaathoven is experienced in Trade Credit Insurance (TCI). He previously worked as CEO of Allianz Trade in The Netherlands, United Kingdom and Ireland. His goal is to take out the complexity which characterises the trade credit insurance industry; to make the products easy to access, easy to use, and easy to understand. Renewing trade credit insurance with banks really integrated.

Niki van Zanten is TreasurUp’s Treasury Innovation Consultant with more than 15 years of experience in corporate treasury with a focus on Foreign Exchange. He has had previous roles as Director of financial risk at Philips Lighting and Foreign exchange and Cash management roles at Cisco systems. His role in TreasurUp is to ensure that all stakeholders, banks, end users, and technology providers designate and meet their goals together. His personal goal is to guide partners to a true financial ecosystem where banks have the right balance between open and in control.

Stay updated on the latest in online Commercial Banking, and subscribe to our monthly LinkedIn Newsletter “TreasurUpdate for Banks.”