Surveys frequently suggest that financial risk managers in companies for FX risks primarily look at cash flows and earnings. Therefore, transaction exposures are the most important hedge items for companies. Because of the visibility, minimizing FX gains/losses is a primary objective for finance managers and treasurers.

Balance sheet hedging is the righteous program to achieve this objective keeping in mind that companies can have multiple objectives like reducing FX volatility vs a budget rate or optimising hedging costs.

As companies can have multiple objectives in terms of managing FX hedge programs like cash flow hedging or net investment hedges, it is difficult to show the effectiveness of such programs.

For balance sheet hedging, there is a direct relationship between the hedged item, which is the monetary balance sheet exposure in a non-functional currency, and the hedge. Many companies are already doing balance sheet hedging to a certain extent, like hedging their invoices. However, many struggle with identifying and hedging their total exposure.

Balance sheet hedging is therefore relevant for companies of all sizes that aim to reduce the FX impact on the P&L. A generic rule of thumb is that larger companies generally have more complex exposures and currency variations.

As opposed to forecasted or anticipated exposures, balance sheet exposures are committed and accounted for and therefore guesswork is needed. Hedging forecasted cash flows and/or net investment exposures requires significantly larger bank credit lines.

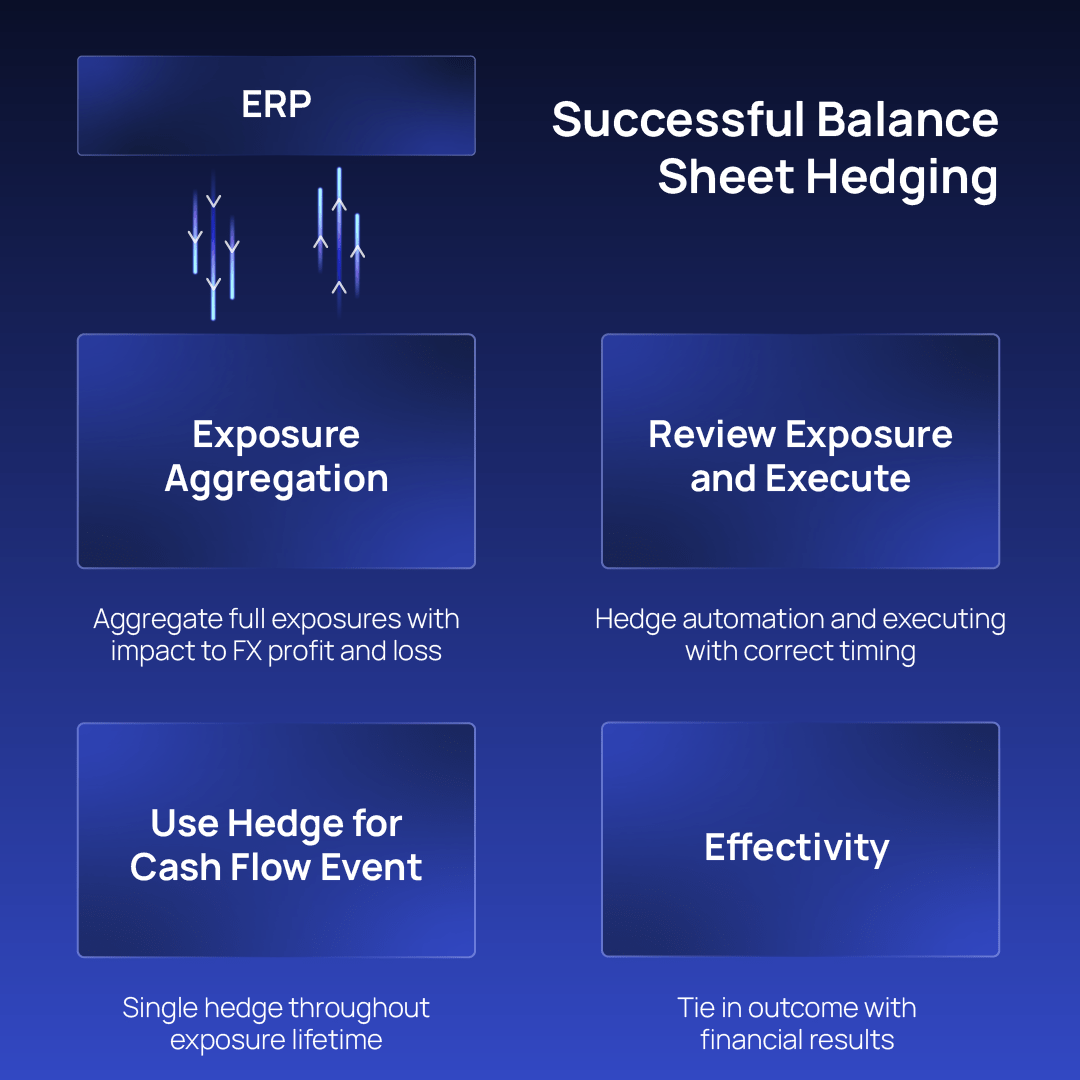

Without getting stuck on the semantics, balance sheet hedging is basically a hedge that provides an offset to all exposures with an impact on the FX profit and loss accounts. These exposures can be extracted from the ERP or accounting systems and should ideally be hedged with a rate that is close to the accounting rate.

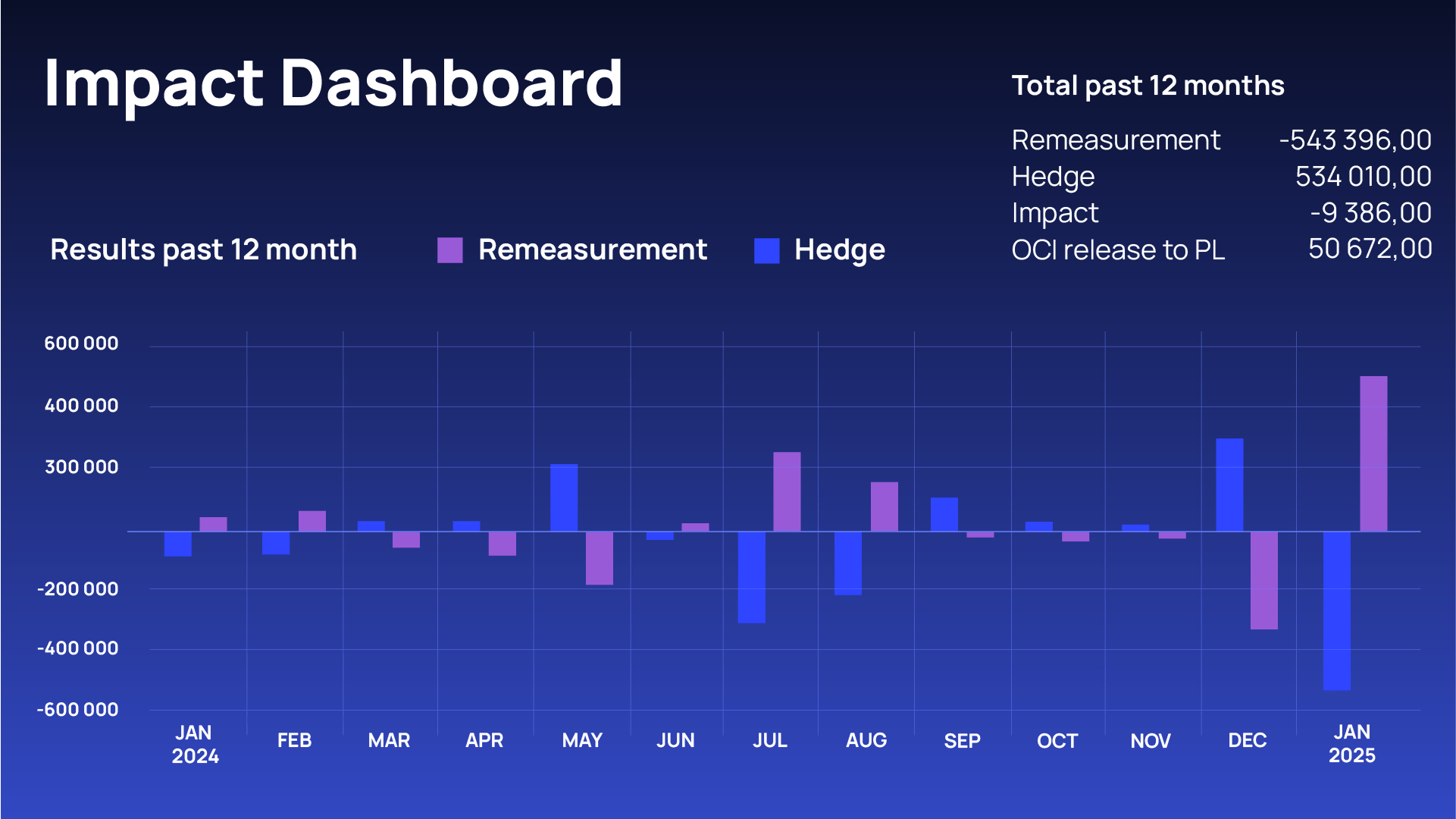

The execution of the hedge can be done until exposure maturity or until the end of the month or financial period. Its effectiveness is shown by the remeasurement of the underlying exposure versus the mark-to-market of the hedges which typically provides a very clear offset.

As the goal of balance sheet hedging is to minimize FX gains and losses the right exposures are balance sheet items that are measured. This can be validated by extracting data from the remeasurements and formatting this as an exposure set that can be hedged.

Selecting the right set of exposures is crucial and balance sheet hedging should cover all exposures with impact on the Foreign Exchange Profit&Loss including but not limited to:

1) Timing is crucial. As the remeasurement of the exposures is calculated using the rate at which underlying balance sheet items are booked vs end of period rate the hedge execution is ideally done close to when the rates are set whether this is daily or monthly.

2) Forecasting is not a must have but to get the best result all invoices that will be booked after setting the P&L rate should be included in the hedges for that period.

3) Automatic adjustments should be made when rolling hedges over to the next period and in case of a deviation of exposures from what’s planned.

4) Easy execution as most of the work is in the setup and monthly aggregation of exposures with the right automation pre and post trade, the execution can be as easy as the execution of a set of trades and even this can be automated.

5) A link between cash movements and hedges is important as the reason for hedging is almost always an actual cash flow that will occur and not linking the cash flow with the hedge will lead to additional hedge cash and an additional risk.

6) Effectiveness is where the true power of balance sheet hedging lies. As all hedged items are on the balance sheet and re-measured with FX rate movements, the executed FX hedges will provide a clear offset to the FX gain or losses hitting the company’s Profit & Loss.

Conclusion

Key users are companies of any size with FX exposures that want to reduce the FX gains/losses in an effective manner.

The complexity of the exposure and currency mix most likely increases with the company size but the principles remain the same. Extracting the right exposures for matching the hedge objectives alongside the correct timing is crucial and best managed with intelligent and state-of-the-art software.

Banks are already providing the relevant products to help clients hedge FX exposure and the next step might be to add a digital toolkit providing their clients the full journey from extracting exposures, analysis, trading as well as using the hedges to effectiveness. The main reason why clients hedge FX exposure is to reduce or eliminate FX impact on the PL so why not help clients remove this pain point?

Ready to learn more? Request a demo of TreasurUp’s solutions to see how we can help streamline your balance sheet hedging and optimize your FX risk management.