To create future-proof business models, banks should focus more on adding value-added services for SMBs. One of the best ways to do this is to help SMBs with the automation of digital processes and better insights by offering integrated solutions. This can create a win-win for both SMBs and banks.

➡️ Click Here and Subscribe to our Monthly LinkedIn Newsletter ‘TreasurUpdate for Banks’

McKinsey – a consultancy firm – argues that future-proof business models of banks should be less dependent on financial intermediation and more focused on value-added services that generate greater customer involvement and sustainable fees (McKinsey’s Global Banking Annual Review, 2021). Therefore, banks must identify which value-added services should be provided to their SMB clients.

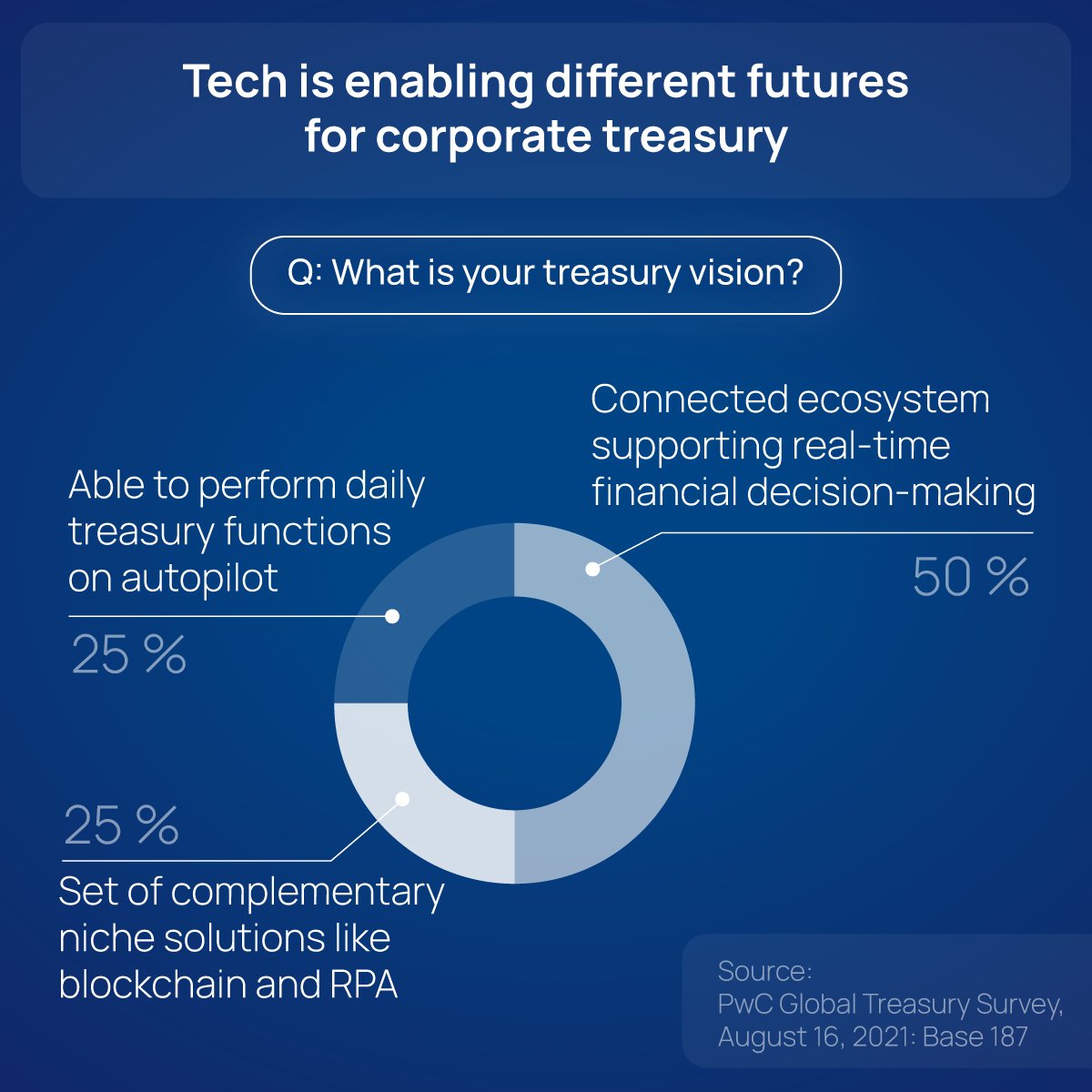

According to PwC’s 2021 Global Treasury Survey, one of the highest priorities for corporate treasuries is accelerating technology adoption to achieve higher automation and deliver real-time services. Half of the corporate treasurers interviewed (50%) want to work towards an interconnected ecosystem to support real-time financial decision-making. Another common goal amongst these treasurers (25%) is to be able to perform daily treasury functions on autopilot. How realistic are these goals? To answer this question, we need to look at the challenges companies face in achieving them.

45% Of the respondents point to “lack of technology” as the key challenge (PwC, 2021). This often relates to the lack of systems supporting reliable data flows and data validation with other company systems (e.g., ERP).

While there are software solutions that can help overcome these challenges, these are generally seen as expensive and hard to use. Respondents of this survey mentioned budget constraints (61%) and the lack of relevant skills (57%) as the main factors preventing an upgrade of their technology stack. We estimate that these percentages are even higher for SMBs, as they generally have smaller budgets for expensive specialized systems and implementation consultants.

Banks are firmly positioned to help SMBs automate and move towards more real-time insights by integrating solutions directly with the bank’s online offering. A logical starting point for banks and their SMB clients would be combining data sources to provide valuable insights. Banks could offer tools to easily collect treasury data, such as bank account data (account balances, transactions) and ERP data (accounts payables, receivables, and orders). This allows SMB users to get insights into cash positions per currency today and to start by projecting how these will develop in the next few months.

TreasurUp is developing a user-friendly ‘Connection Center’ which can be integrated into the Commercial Banking offering of the bank. The Connection Center offers a self-service user interface that allows companies to easily collect relevant treasury data by taking away as much complexity as possible. It offers pre-configured connections to more than 20 popular cloud ERP platforms allowing users to establish a connection within minutes. For companies using on-premise ERP software, there is a data collector that can interface with 500+ ERP platforms. Data from (external) bank accounts can also be retrieved in minutes using (PSD2) APIs.

While we think pre-configured connectors are the way to make data integration easier, it is also important to cater to customized data integration. Therefore, the Connection Center allows users to generate their API credentials and communicate directly with the API endpoints, allowing two-way communication between the Connection Center data and external company systems.

The Connection Center will enable SMBs to easily collect data from multiple sources and use that data to automate treasury processes and obtain real-time insights. A few examples of how the data from the Connection Center can be used for corporate treasury insights:

The insights that the Connection Center can offer to SMBs can be valuable. But why would banks want to offer such a tool to their clients? The answer can be found by looking at the downstream process, i.e., what happens after the data has been collected and interpreted? Usually, the next best action is identified by the company. The bank can benefit from this by offering integrated commercial banking products most suitable to the company in a given situation.

Some examples:

All solutions can be integrated into the same online environment, allowing the bank to offer a one-stop-shop to their clients and covering a large part of the interconnected ecosystem corporate treasurers aim for. For the bank, this can result in higher deal flow and revenues. Moreover, providing at least a portion of corporate treasury workflows reduces the risk of disintermediation for banks in the longer term (McKinsey, 2021).

The Connection Center is a white-labeled solution for banks, and its launch is scheduled for Q4 2022. While the Connection Center fully integrates with all other TreasurUp solutions, it can also work as a standalone solution.

Click here if your bank would like to have a demo of TreasurUp’s Connection Center.