Corporate demand for modern and sophisticated cash and liquidity services has never been higher.

Banks have traditionally been at the core of this business; however, the game has radically changed and reaping the opportunity entails a sweeping re-thinking of their treasury approach, strategy and capabilities, both from a business and from a technology standpoint.

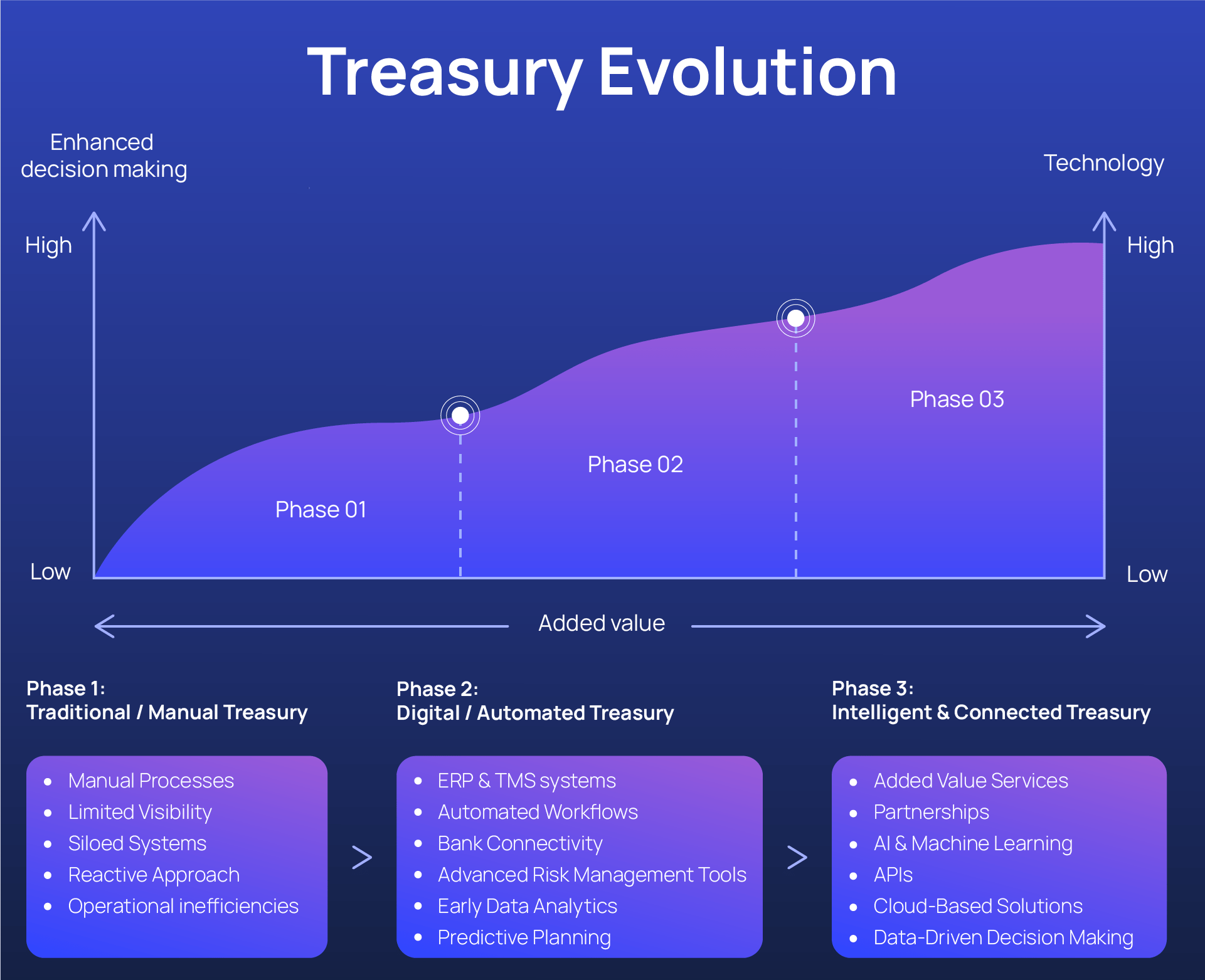

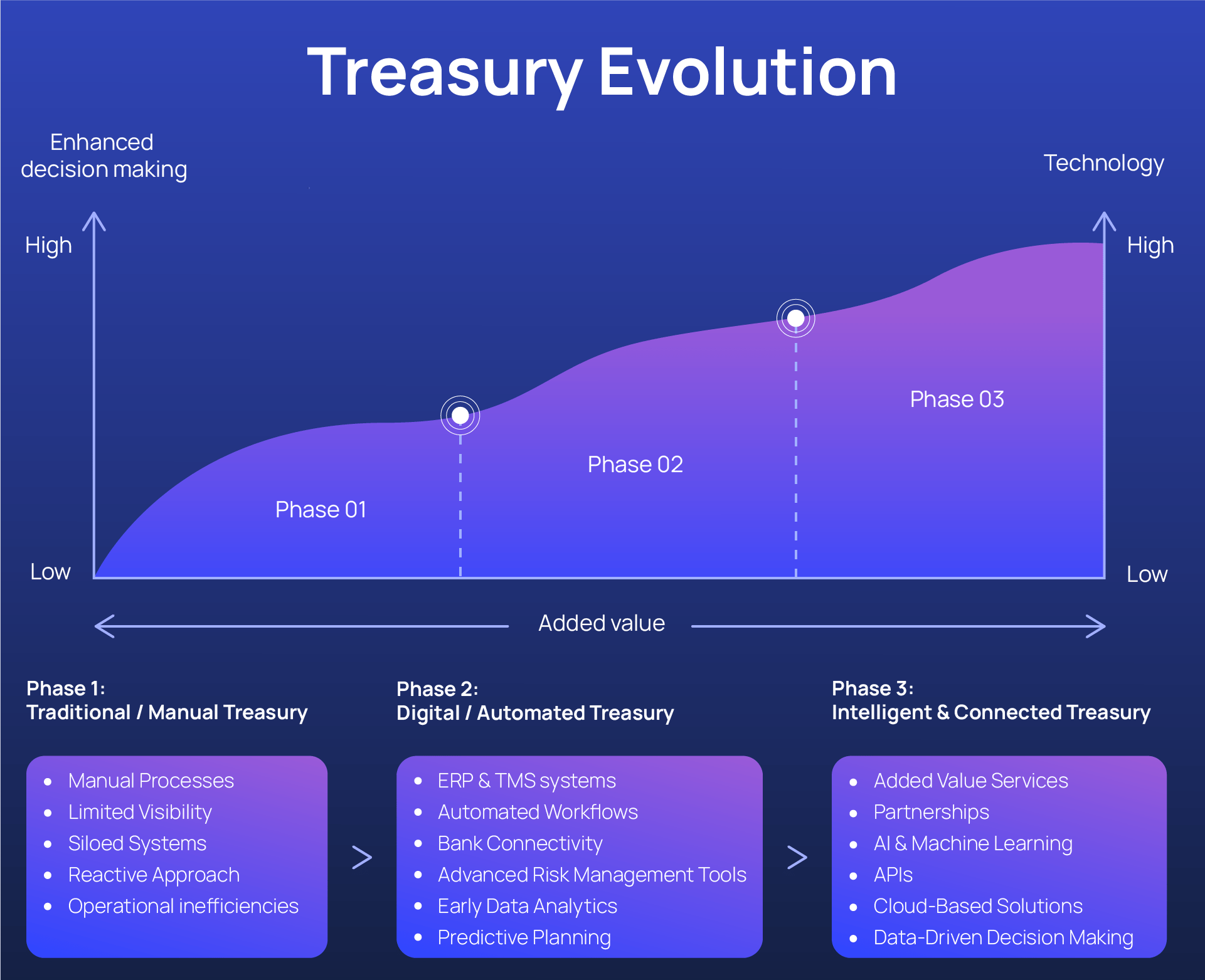

The Evolution of Corporate Treasury Needs

Companies fail primarily because of (lack of) liquidity. Whereas this has always been the case, the attention to cash management has not always been proportional to its significance.

The pandemic proved a wake-up call that showcased, unfortunately for many businesses the hard way, that a prudent corporate treasury set-up can very often constitute a make-or-break factor.

At the same time, treasury priorities have seen a massive multi-directional shift. Insights from HSBC’s 2024 Corporate Risk Management Survey (529 senior treasury professionals from corporates across a range of sectors were interviewed) are telling:

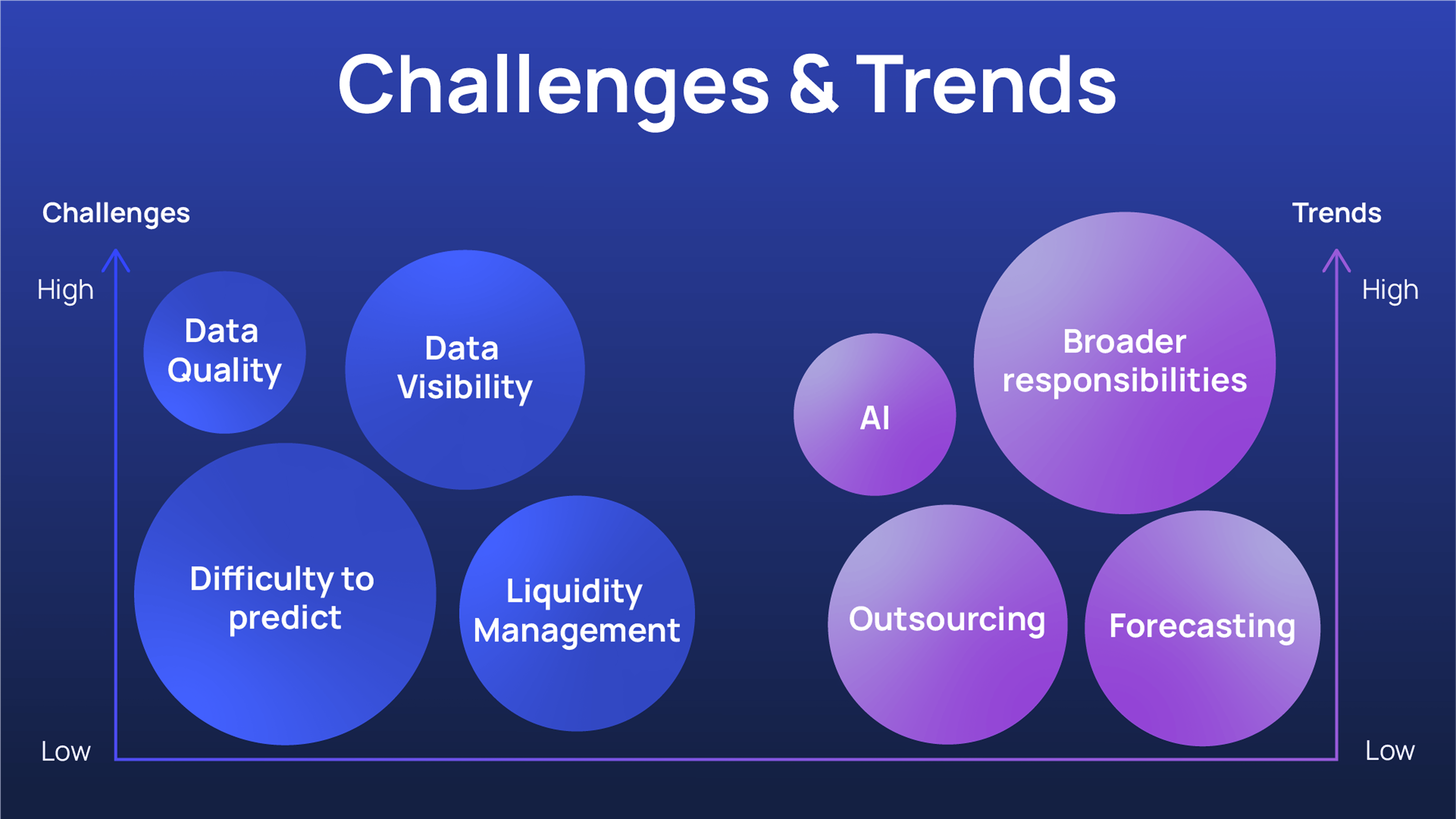

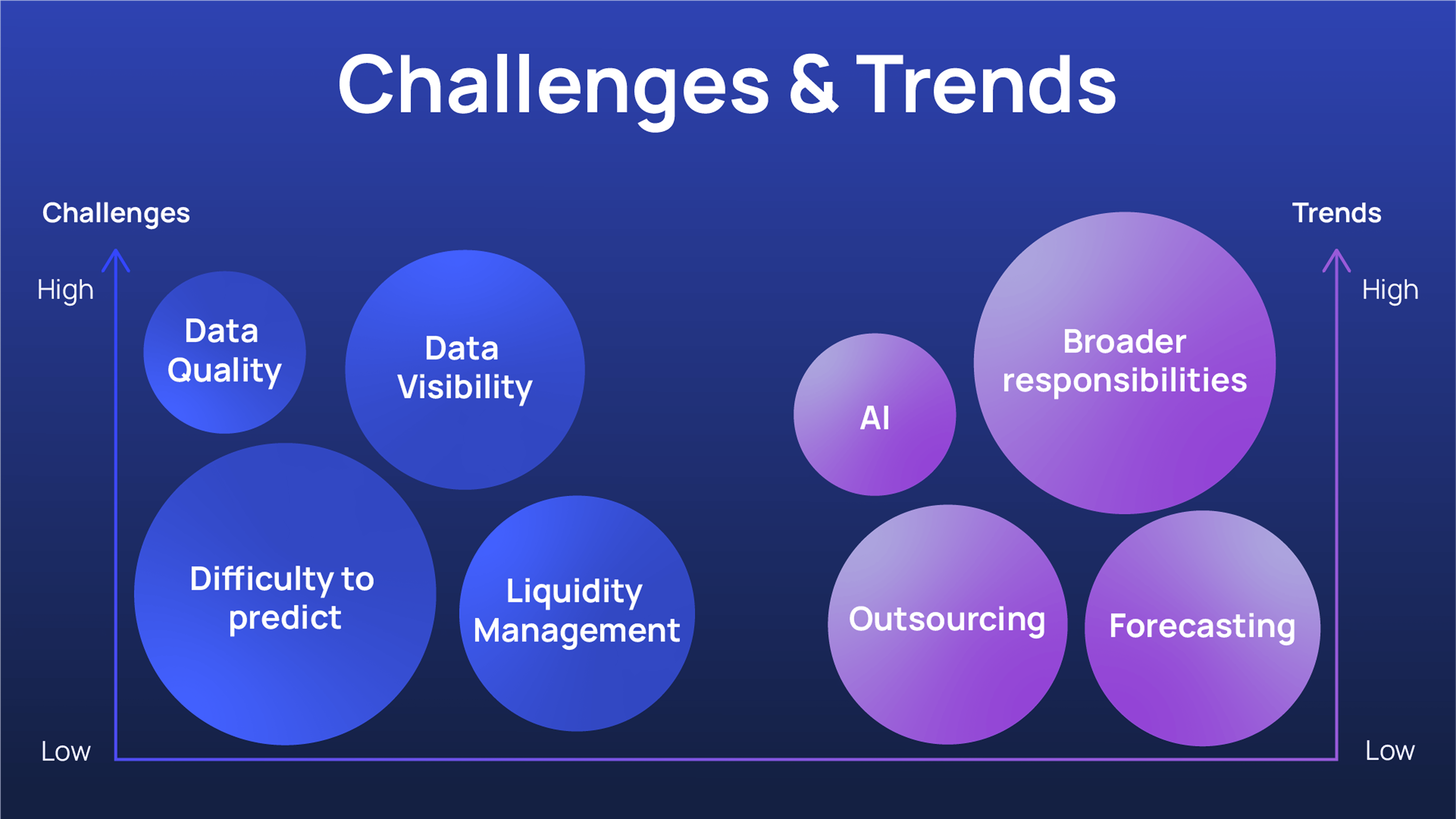

- Many risks treasury functions face are difficult to predict because they are not driven by macroeconomic events alone. For example, more than half of treasurers in EMEA (60%) and 49% overall said the accuracy of underlying data remains the largest challenge for FX cash flow hedging programs.

- Treasurers are struggling with the internal quality of cash flow forecasting data. Some 93% of respondents said those data inaccuracies had led to avoidable losses over the past two years alone, either due to overborrowing or liquidity shortfalls.

- Many companies face challenges with data visibility, particularly in obtaining timely insights into liquidity management. Existing solutions for managing available liquidity often fall short, making it difficult to identify where liquidity shortfalls exist (e.g. across their various entities).

- 53% of respondents are using or considering outsourcing to enhance the profile and efficiency of their treasury.

- 41% of respondents say the responsibilities of their treasury have become broader in the past three years.

- The emergence of Artificial Intelligence (AI) is expected to create tailwinds for businesses and their treasury function. Treasurers are putting high expectations on AI to improve their efficiency with the following areas standing out: data collection and analysis (82% of respondents), cash flow forecasting (52% of respondents), fraud detection (38% of respondents).

- Top treasury tech and automation investment areas include group-wide cash flow forecasting, loan processing, credit risk management, reporting and analytics, cash pooling and intra-group funding.

Banks’ Positioning and Challenges

For banks, the management of cash and liquidity not only remains their main funding source but is also the basis for adjacent revenue sources via cross-selling and up-selling. FX and transaction fees are good examples.

Despite this critical dependency, banking offerings have not largely caught up with customer needs with visible gaps across several domains:

- Outdated, legacy systems that don’t support some of the core principles of doing business today such as API integrations or flexible, cloud-based scalability options.

- Batch-based payments processing.

- Inelastic product features.

- Rigid liquidity structures.

- Limited cross-border capabilities.

- Non-transparent pricing.

The threat for banks is clear: the competitive landscape is being disrupted with new, agile players (e.g. fintechs, technology companies or payment providers) joining the race and pushing further down already shrinking margins. And despite long-established banking relationships, this time around corporates are more susceptible to discussing or accepting solutions from this new breed.

Banks still have time to react. But they need to do so in a coordinated way that addresses challenges from a strategic perspective as well as from a technological one.

Banks’ Strategic Options

Although there is no one-fits-all approach, these are some strategic directions worth considering:

- Move from offering just products to becoming a client advisor that solves problems through holistic, end-to-end propositions. Banks need to look at the big picture and this is about helping corporates to be more efficient, grow their business and better manage liquidity and risks. Providing the right tools and the right advice in the appropriate context is key.

- The holistic, end-to-end approach should go far beyond the product proposition and include the servicing of key corporate relationships that significantly influence the treasury set-up. Providing tools that allow the integration, for example, of buyers and suppliers and of their respective workflows, is not only a game changer but also enhances the overall added value of the entire proposition.

- Modern treasurers are looking to their banking providers to enable centralized, real-time visibility into cash positions across all global entities and currencies. This includes tools for automated cash pooling to address working capital gaps, predictive analytics to forecast liquidity needs, and instant cross-border fund transfers to ensure liquidity is available exactly when and where it’s needed.

- As corporate treasury becomes increasingly entangled in businesses’ strategic decision making (beyond the operational side), it is critical for banks to be able to offer real-time dashboards and reporting integrated with the treasurer’s ERP and TMS systems. Functionalities such as tracking daily cash positions, interest expense trends, liquidity buffers, and compliance risks (e.g., covenant breaches) have become an integral part of modern oversight and strategic decision making.

- Banks should realize that they have neither the resources nor the capability to build everything on their own. The best thing is that they don’t have to. The use of partnerships and strategic providers (white labeling to be considered) can be vital in terms of not only a timely go-to-market but also of securing access to state-of-the-art capabilities.

Technology as The Key Enabler

On the enablement side, the role of technology in transforming treasury operations has never been more crucial. Beyond the given scalability, security and compliance considerations, here are some treasury-specific guidelines:

- Leverage cloud infrastructure to deploy multi-bank connectivity, real-time cash positioning, and payment automation at scale.

- Choose a buy approach (vs a build one) to leverage flexibility, scalability and fast go-to-market. Providers with pre-built APIs and a modular set-up can allow for seamless integration in high-demand areas such as liquidity management, FX, and payments.

- Ensure seamless connectivity between legacy systems, new platforms (e.g., APIs, cloud), and third-party tools (e.g., ERP, payment gateways) to avoid silos and enable unified data flows.

- Embed AI-driven fraud detection and sanctions screening into transaction workflows. Integrate automated audit trails and compliance reporting tools.

- Offer centralized liquidity insights via aggregating cash positions across partners and platforms into a single dashboard. Use AI-powered forecasting to identify liquidity gaps, optimize working capital, and model scenarios. Provide real-time dashboards for global cash visibility.

- Integrate FX execution into payment workflows (e.g., auto-hedging during payment initiation). Deploy AI-driven currency analytics to optimize hedging strategies and reduce costs. Streamline cross-border transactions with dynamic multi-currency netting.

- Offer sandbox environments for corporates to test API integrations and simulate cash management workflows.

Banks clearly face a completely new reality, in which corporate treasury has gained in significance, scope and complexity, while having to address challenges (e.g. financial resilience, risk management, cybersecurity, and business growth) that go far beyond its traditional scope.

In such a fast-changing environment, their ability to adjust will be crucial for making it to the next phase. This will, in turn, depend on three main pillars:

1) The shift from a transactional focus to added value services

2) A modular set-up offering customization flexibility based on client feedback (treasurers get to shape the offering)

3) The use of technology as an innovation enabler.