In December 2023 TreasurUp undertook some strategic change which has clearly resonated with our bank clients and is underpinning an intensity of new opportunities.

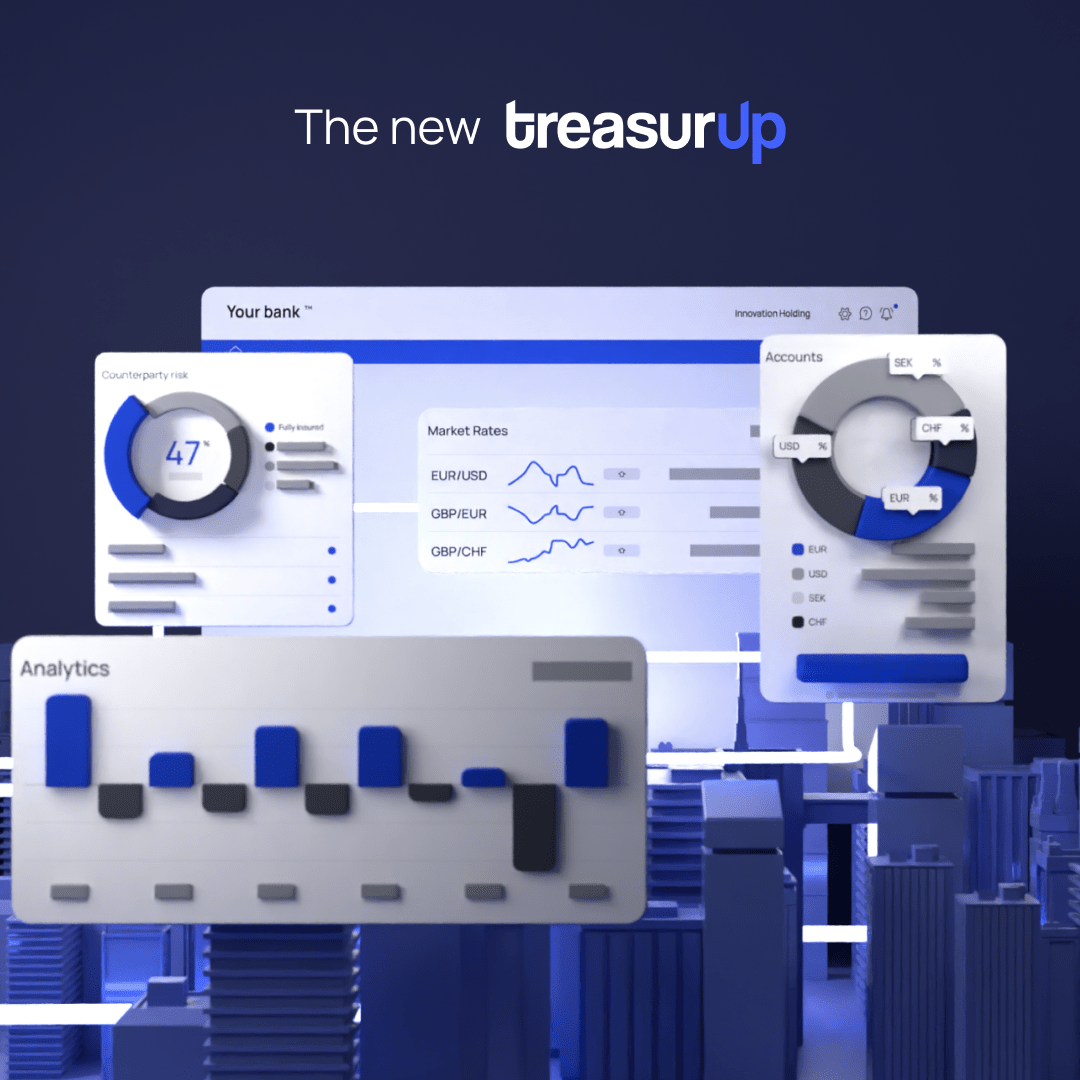

European banks were initially introduced to TreasurUp as a specialist provider of white-label FX front-ends targeted at Corporate and Commercial customer segments. Since then, both existing bank clients as well as new prospects have asked us to design and develop new, complementary solutions that is shaping the new TreasurUp.

Together with one of our bank clients in Scandinavia, we have recently launched a self-service cross-currency target balancing module which has garnered terrific feedback from both the bank and its Corporate clients during the pilot phase. Additionally, TreasurUp has introduced a completely new approach to cash visibility and cash flow forecasting, that banks can deploy to enrich their value proposition. Providing some decision support and analytical capability alongside conventional account information displays. With what we have learned through the course of 2024, TreasurUp remains intently focused on helping our clients to grow their Commercial Banking business.

During the last two quarters, TreasurUp has been engaging with some new relationships and through these has begun to create some product concepts that have tremendous potential. We are now looking past the obvious transactional capability required for business clients and are designing workflows that enable investment mandates to be executed across deposits, bonds, repos and commercial paper. Clients of banks can define their mandate permissions or restrictions, based on an investment policy that our UI workflow makes easy to establish. Investible capital can be allocated and transacted across an optimized portfolio mix with an easy click and confirm, simplifying processes and providing an audit trail that can be reviewed in line with investment risk preferences.

TreasurUp is also working closely with Movitz Payments to design the ultimate cross-border payments experience that banks could offer to their company clients. This includes country-specific compositions of screens and confirmation of payee based on beneficiary details. It has the flexibility to incorporate both static or live streaming FX rates and FX Forward draw down options. Increased flexibility in workflow that banks are seeking to deliver to Corporate clients.

Last but not least, TreasurUp is going global. As of August 2024, we will have two dedicated relationship managers covering banks in the US and Canada. Knowing that our existing team has strong relationships in Europe and APAC, we can now offer full global coverage for banks that are planning on uplifting their Digital solutions.