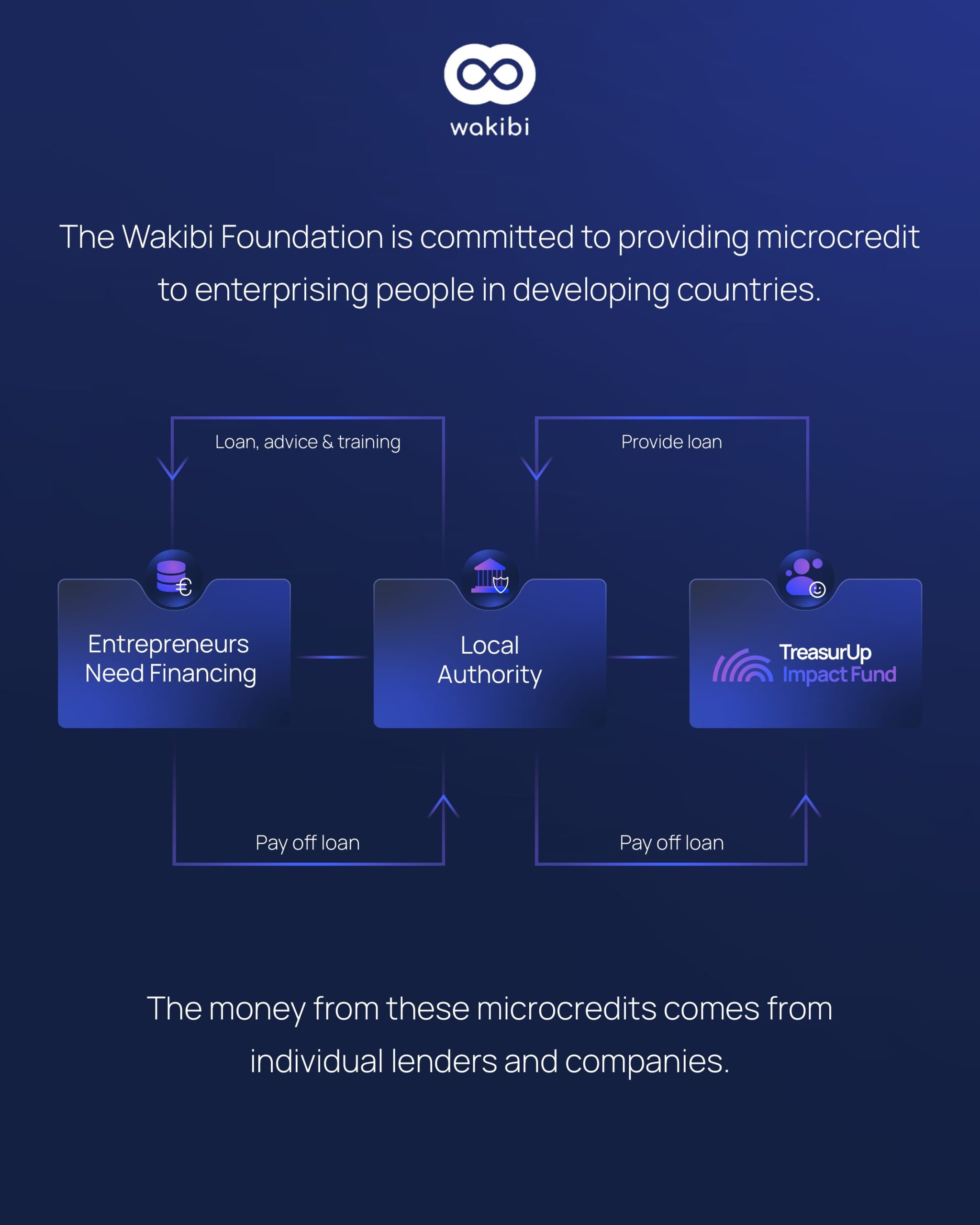

We believe in creating a better world by enabling forward-thinking solutions for the next generation. Our commitment to innovation, long-term focus, and genuine contribution has led us to partner with Wakibi, a microfinance platform supporting over 130,000 entrepreneurs in developing countries.

Through the TreasurUp Impact Fund, we are empowering students and entrepreneurs by providing microloans that spark long-lasting change.

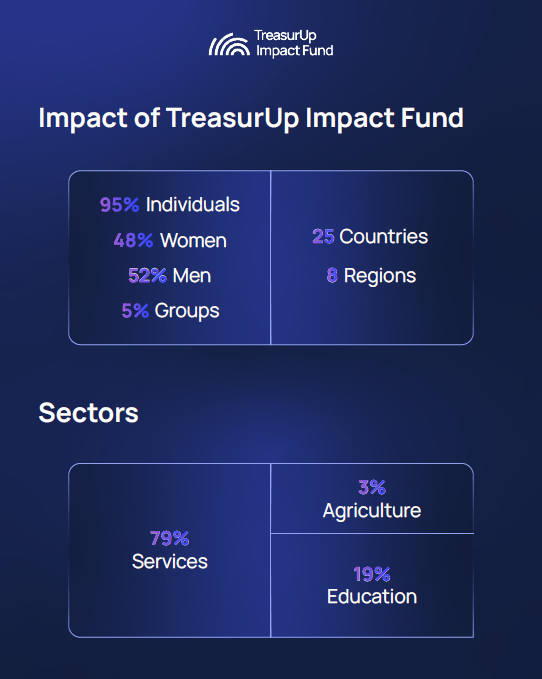

In the first months of 2025, the TreasurUp Impact Fund has already reached eight countries, supporting individuals and groups across diverse sectors:

Every repaid loan gets reinvested, creating a circular model that continuously supports new ventures and educational pursuits.

Meet a few of the inspiring changemakers who’ve benefited from the TreasurUp Impact Fund in partnership with Wakibi:

A driven mother of two who renovated her photo studio, ensuring a brighter future for her family and children’s education.

A social enterprise bringing solar-powered lighting to rural communities, helping thousands of families gain reliable electricity.

A determined father and student, using microfinance to cover tuition for his Technical Technology program, fueling a career aimed at bettering his community.

Microcredit offers more than just a financial boost; it provides independence and a pathway for sustainable success. By partnering with Wakibi, we ensure transparency, guidance, and a proven strategy for reinvesting loans once they are repaid. This cyclical model fuels an ever-expanding ripple of education and entrepreneurial progress.

Step by step, we aim to scale the TreasurUp Impact Fund to support more innovators and learners who embody the spirit of positive disruption.