Cash is the lifeblood of any business. But what happens when some of that cash sits idle, accumulating in various accounts? Banks can help their business clients which have”excess liquidity” by generating and optimizing yield with their products. TreasurUp has developed an award-winning front-end solution that banks can provide to business clients.

Cash often gets scattered across numerous accounts, making it difficult to track and optimize its use and potential yield. At some point, when companies realize that, they may use non-bank parties that have pointed them to this opportunity for these yield products leading to churn on the bank side. What if the bank would offer the best investment product website for business clients?

With TreasurUp’s Cash Visibility module on top of the bank’s core account balances/Transaction Banking platform(s) companies can be signaled that a certain amount per currency sits idle in the account. The company may then want to consider yield products.

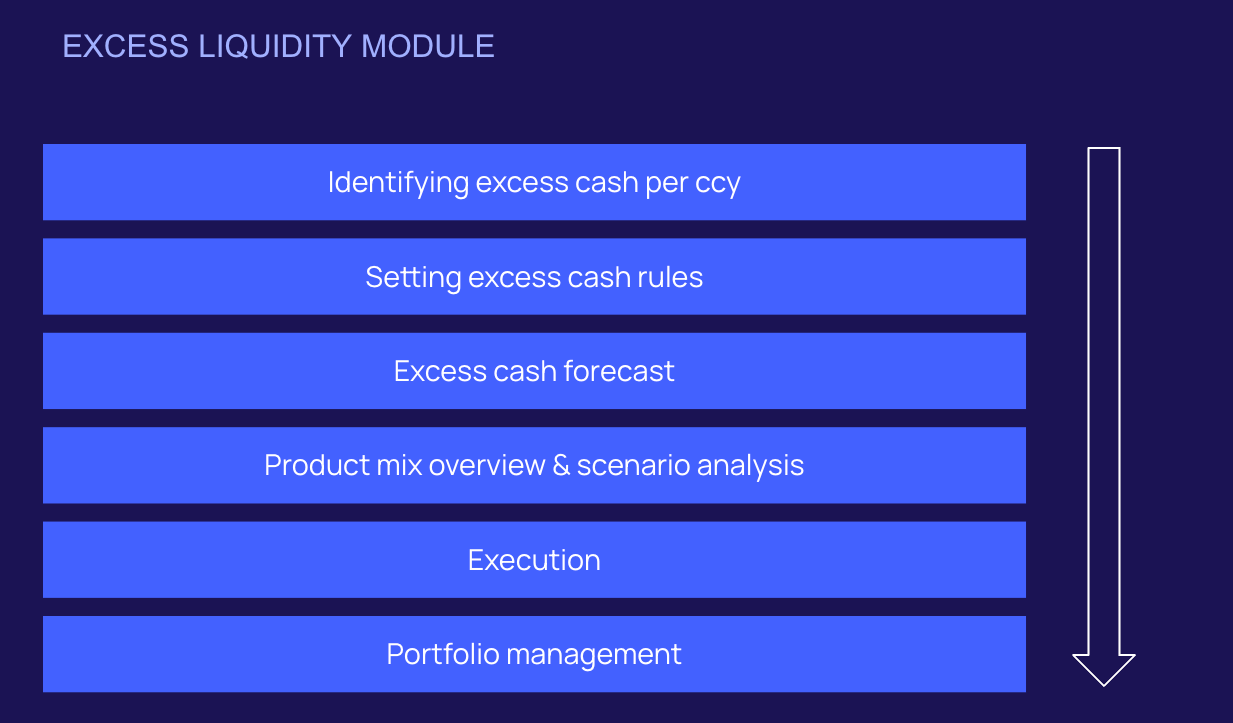

Subsequently, TreasurUp’s Excess Liquidity Module would help a business client of a bank to provide input on which asset classes and product types the company would consider. It would also ask for an excess cash prognosis for the next few months or quarters.

Once that input data is provided, the module assists in selecting various products whereby the allocation percentage can be altered. These could range from a savings account to deposits, Commercial Paper and Bonds, depending on the bank’s capabilities. Once final, the company user can execute all transactions at once and monitor its portfolio.

We’re thrilled to announce that TreasurUp’s Excess Liquidity module has been recognized by Global Finance magazine with the prestigious “Best Excess Liquidity Solutions in Commercial Banking” award for 2024!

This award underscores our commitment to providing innovative solutions that empower businesses to optimize their cash management. Our Excess Liquidity module tackles the challenges mentioned above by offering the following features:

The module automatically identifies excess cash across all your accounts, eliminating the need for manual calculations and data gathering.

Based on your financial goals and risk tolerance, TreasurUp suggests optimized ways to utilize your excess funds. This could include money market investments, fixed-income products, or even FX swaps.

Automated workflows free up your time and resources. You can focus on strategic financial decision-making while the module handles the heavy lifting.

Gain complete transparency into all your cash holdings, giving you a clear picture of your financial position.

Automate time-consuming tasks and free up your team to focus on more strategic initiatives.

Earn higher returns by strategically deploying your excess funds and optimizing your cash management strategies.

Mitigate the risks associated with idle cash by actively utilizing excess funds.

Don’t let your excess liquidity become a hidden liability. TreasurUp’s award-winning Excess Liquidity module empowers you to take control of your cash, maximize returns, and achieve your financial goals.

Ready to unlock the hidden potential of your excess cash? Contact us today to learn more about the Excess Liquidity module and Request a Demo here.