It’s hard to deny that AI is a mega trend in banking and business in general. The combination of the power of computing hardware, capabilities to create intelligence and an open ecosystem brings many possibilities to commercial banking if we can let everything fall into place and bring the needs of clients closer to banking solutions.

Taking the view of the commercial banking client’s needs we will try to sketch how the financial sector landscape and ecosystem will evolve with AI.

Commercial banking has not seen the same investment levels as retail and institutional banking. The IT infrastructure and platforms used by banks are legacy systems that are either stripped down or overly complicated. This also goes for commercial banking clients and their systems, typically an ERP or accounting software package and spreadsheets. Although the companies work in a professional manner they do not have dedicated resources for each niche in financial markets and bank products.

The Value in the financial ecosystem can be created not only by a platform but also by developing user journeys that give bank clients comfort that the bank is providing transparent and personalized solutions that help professionalize clients and solve their key issues.

In short, the question for commercial banks is how to create intelligence that transforms a bank client relation from product selling to solution providing.

Towards the end of the 21st century, the world was in an era of steep economic growth, opening markets and globalization. The company Treasurer went from managing a part of a local organization where business was done in person or over the phone to a more centralized position.

The challenges treasurers faced shifted to making sure the data in terms of bank account statements and reporting matches the structure of the company. Most of the work was manual. Global bank relations shifted as well, banks were looking to grow into large global network banks.

At the beginning of this century, digitisation kicked in and the focus shifted to automation, linking systems and robotics. An example of linking systems are the Treasury management systems which were connected or integrated to ERP systems as well as digital trading platforms. This enables companies to run smoother operations but the Intelligence at this point was still a manual people exercise. Easily a solution for one problem could lead to a problem somewhere else.

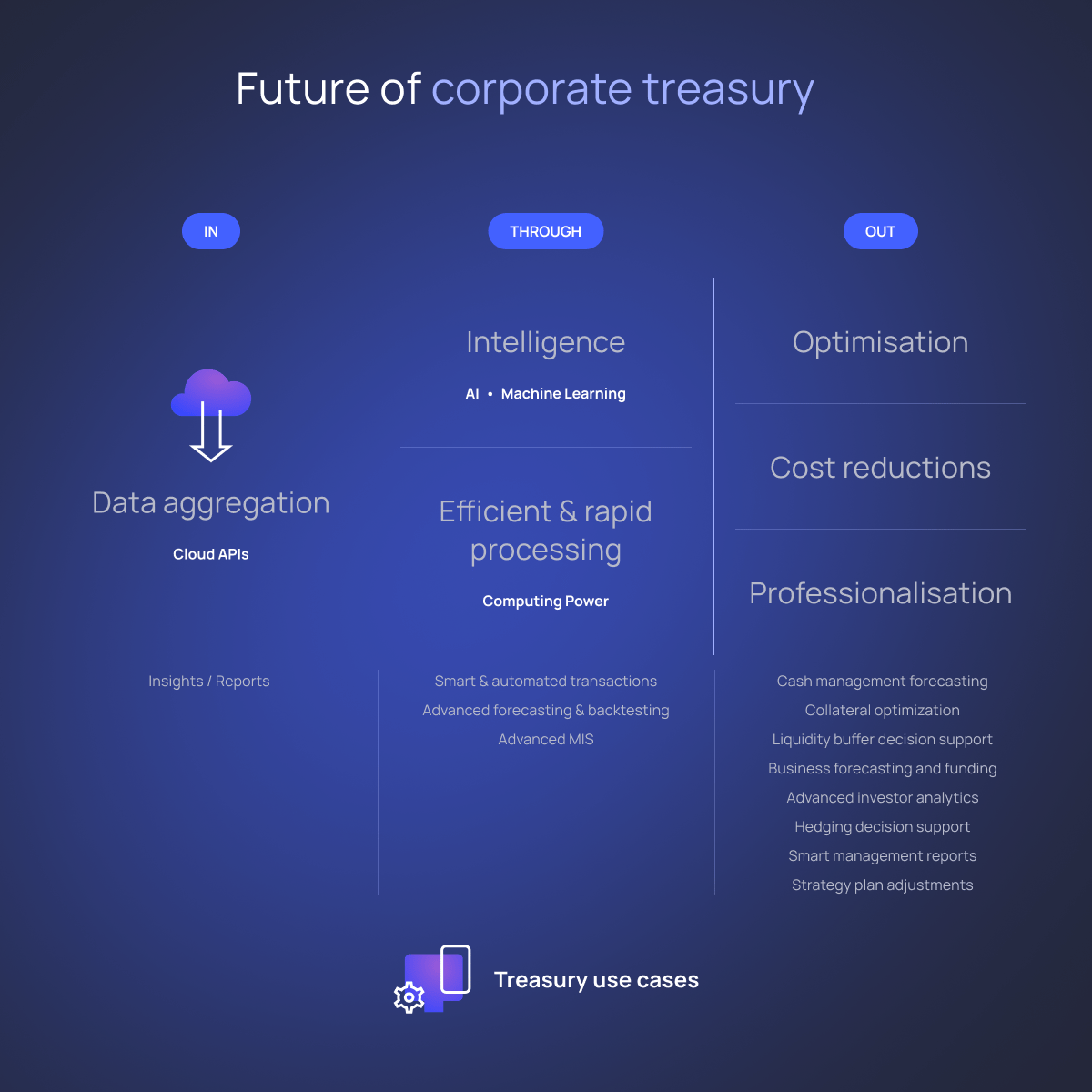

AI developments now create possibilities for creating intelligence in these and opening the doors to the optimisation phase. This optimisation will be achieved by increased predictability of how financial products will help a company reach its goal but also in an easier way to set up a policy or execution framework.

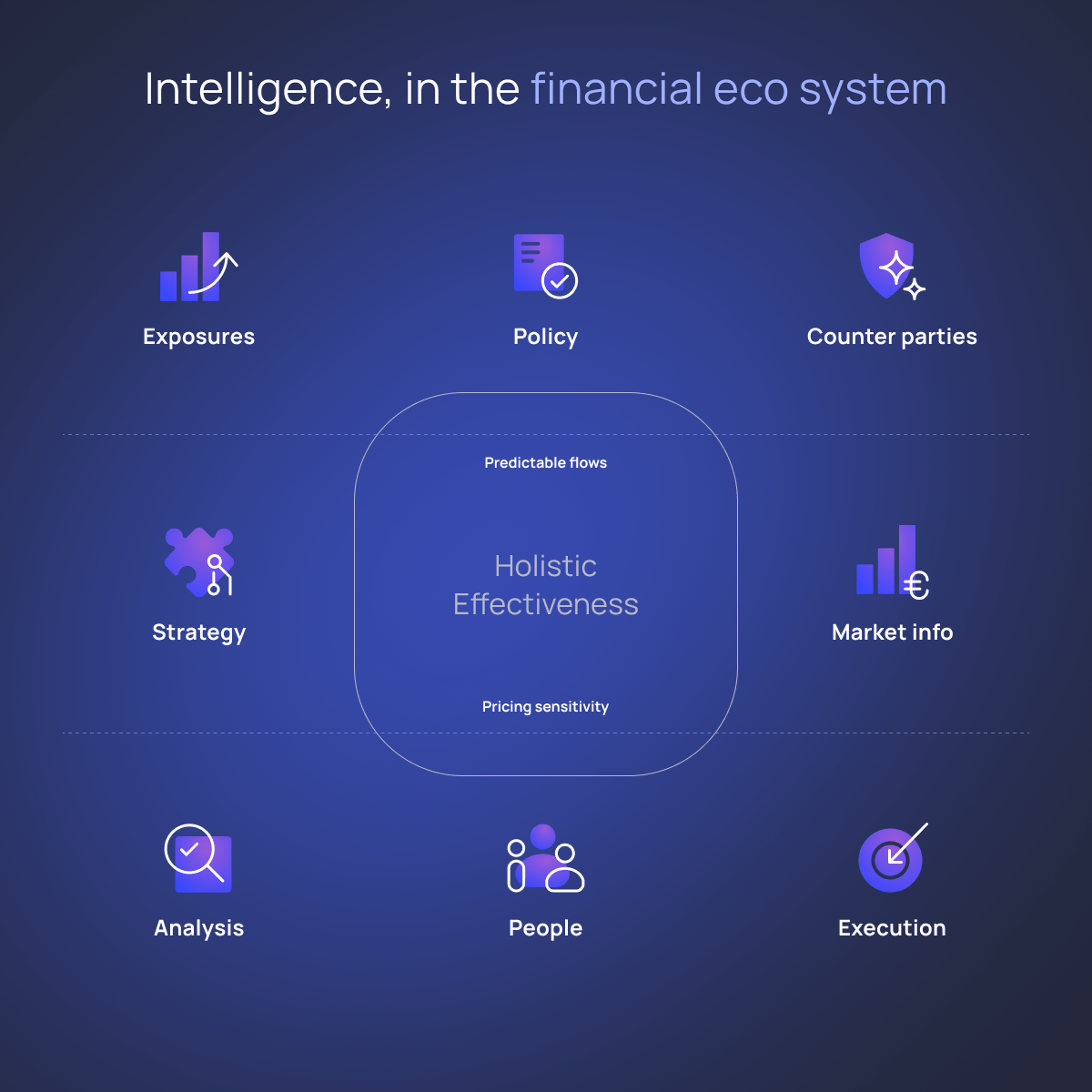

AI and Ecosystem can bring the common goal of Holistic Effectiveness closer by for instance not only setting up rules but also validating through connecting data sources and increasing the predictability of flows. Fundamental market risk will stay but options on how to manage this will improve.

Computing power has moved backtesting of Hedge strategy from a massive mainframe computer and days work to a model that runs on a tablet which allows companies with the help of their banking partner to look at financial risk exposures across the board and tie them into company targets from the start.

Another interesting example is finance health monitor where banks can show companies what their risk levels are to peers but also show analysis how certain decision like insuring receivables can affect the risk monitors. AI can be used to scan financial information like annual reports from peers but also help to identify if a company action can lead to a breach in the covenant with their main bank.

Banks have made large steps in digitisation in some business silos. FX for example not only has a high digital penetration rate but also data points available have become easy to access and real-time and it’s a truly real-time global market. However, the focus is often on trading when the challenges of clients are much broader than trade execution.

Clients don’t always have the budgets, priorities or skills to leverage and implement APIs or Machine learning solutions but with a banking partner all elements of AI, Machine Learning, controlled data sets and computing power can be put together to leverage financial products to meet clients financial targets with higher predictability and effectiveness.

Banks can start now with using AI to do user setup and anomaly detection and then move towards client facing applications of technology. Using an ecosystem is also a way for banks to fill in product gaps they have with their clients without full implementation and balance sheet allocation. This is driven by API technology but also by data analytics to sketch the landscape with a different product portfolio.

AI is coming and it will do amazing things but they might be different and perhaps bigger than what the most marketed use cases are. A vision looking beyond cost efficiency results and small implementation steps are required to shape the future and grow the bottom line of a bank as well as the clients.

Niki van Zanten is TreasurUp’s Treasury Innovation Manager with more than 20 years of experience in corporate treasury with a focus on Foreign Exchange. He has had previous roles as Director of financial risk at Philips Lighting and Foreign exchange and Cash management roles at Cisco Systems.

His role in TreasurUp is to ensure that all stakeholders, banks, end users, and technology providers designate and meet their goals together. His personal goal is to guide partners to a true financial ecosystem where banks have the right balance between open and in control.

We are a Dutch FinTech company that provides banks around the world with innovative online front-end solutions for their business clients.

These solutions are tailored to and designed for the bank, white-labeled and offered through Web, Mobile and APIs. We offer solutions for bank business clients in the areas of:

Risk Management

Liquidity Management

Finance

We believe in a bank & fintech partnership model and are proud to have clients like Nordea, Rabobank, KBC, OP bank, SEB, Handelsbanken, OLB, Sparkasse and LBBW. For more information about our tailored solutions for bank business clients please feel free to reach out: Request a Demo here.

Stay updated on the latest in online Commercial Banking, and subscribe to our monthly LinkedIn Newsletter “TreasurUpdate for Banks.”