Generative Artificial Intelligence (GAI) is promising advancements in earnings growth, decision-making processes, and risk management strategies, but it also introduces new risks and implementation costs. This exploration delves into the recent examples of applications of GAI within commercial banking, exploring developments within customer service and compliance, agent productivity, and software development.

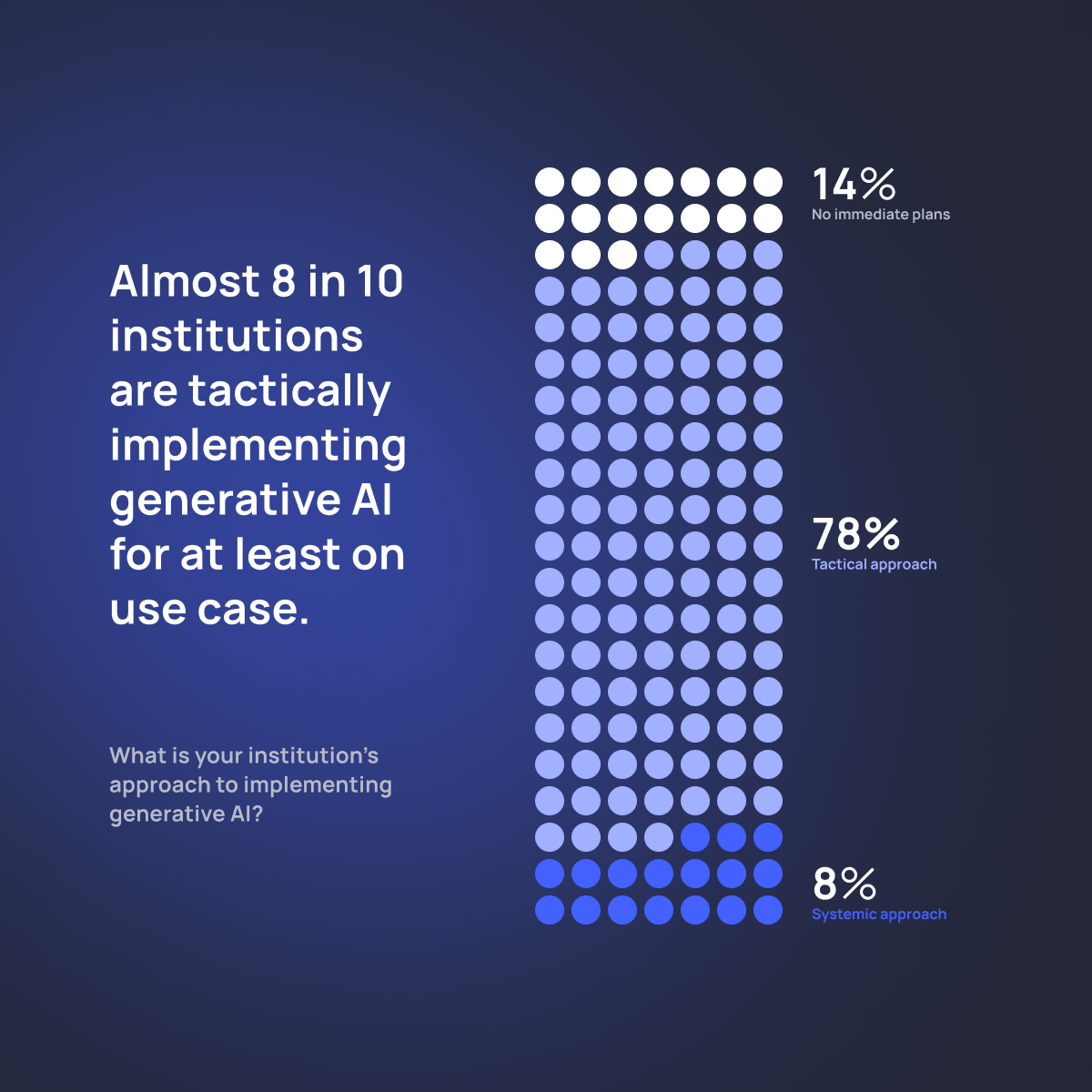

While AI is not new to the banking industry, the advent of GAI models, especially post-ChatGPT’s launch, has markedly accelerated its adoption and scope. European bankers foresee a significant transformation within the sector and as of January 2024, 86% of banking institutions are either actively implementing or preparing to launch applications utilizing GAI models.

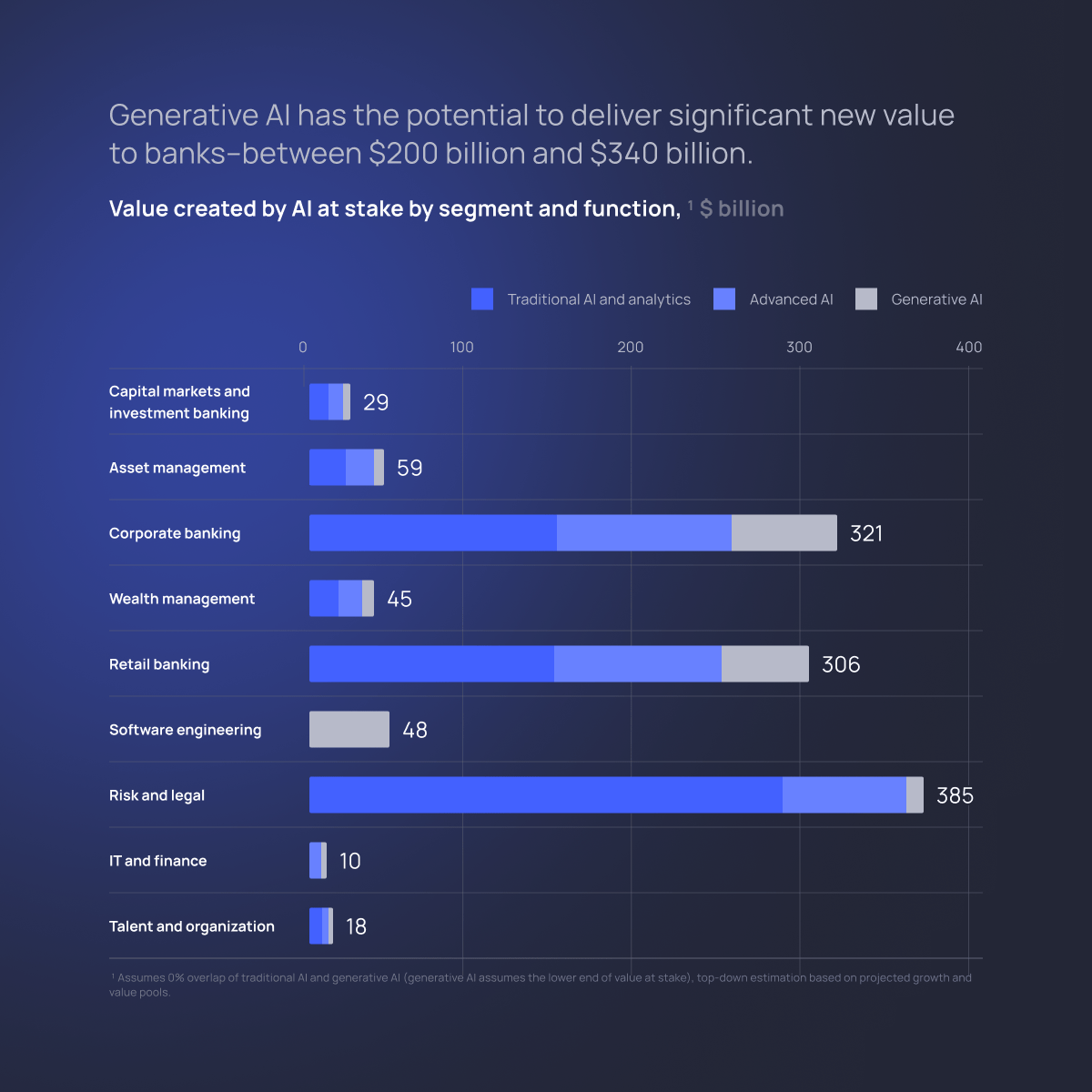

The McKinsey Global Institute underscores this potential, projecting an annual opportunity worth $200 to $340 billion primarily through enhanced productivity.

Source: The economic potential of generative AI: The next productivity frontier, McKinsey Global Institute, June 2023; QuantumBlack, AI by McKinsey traditional advanced analytics and AI analysis

The approach banks take to develop their GAI capabilities is expected to vary based on their size and the resources they can dedicate to such initiatives. They have several pathways to explore, from engaging third-party providers for outsourcing to conducting development in-house. Software providers that are essential to the operational framework of banking institutions have embedded GAI across their offerings, exemplified by the recent addition of Microsoft Copilot for Finance.

Additionally, banks are considering a variety of hybrid strategies, which may include adjusting and refining pre-existing models to suit their specific needs. JPMorgan Chase, a frontrunner in AI maturity, exemplifies this trend with over 300 AI use cases, setting a benchmark for the industry.

GAI’s recent development in banking is largely concentrated in three areas:

These applications not only augment employee performance but also enhance customer management and streamline software development.

Last year, JPMorgan filed for the trademark of IndexGPT, a ChatGPT-like software service designed to provide personalized investment advice to customers. With IndexGPT, customers will be able to know about the various investment products in the market easily, reason and pick suitable options based on their current financial health. The AI software will then guide customers on how to invest in these stocks and funds. The product is likely to be launched between 2026–2027, depending on the trademark approval.

Morgan Stanley Wealth Management has announced that the bank will use OpenAI’s GPT- 4 to deliver content and insights into the hands of financial advisors. Morgan Stanley will use the technology to access, process and synthesise content to assimilate its own range of intellectual capital in the form of insights into companies, sectors, asset classes, capital markets, and regions around the world. Called the AI @ Morgan Stanley Assistant, the tool gives financial advisors speedy access to the bank’s “intellectual capital,” a database of about 100,000 research reports and documents.

While some firms’ chatbots can handle common account servicing requests, GAI models offer detailed answers to more complex queries. An example is Wells Fargo’s GAI virtual assistant named Fargo. The assistant has reportedly handled 20 million interactions since it was launched in March 2023 and is poised to hit 100 million interactions annually. Using Google’s PaLM 2 LLM, the app is designed to answer customers’ everyday banking queries and execute tasks such as giving insight into spending patterns, checking credit scores, paying bills, and offering transaction details, among others.

Mastercard will later in 2024 launch its own proprietary GAI model to help thousands of banks in its network detect and root out fraudulent transactions. Its new advanced AI model, Decision Intelligence Pro, will allow banks to better assess suspicious transactions on its network in real-time and determine whether they’re legitimate or not. Mastercard anticipates its algorithm will enable banks to save as much as 20% by eliminating the costs they’d typically devote to assessing illegitimate transactions.

GAI code assistants are helping companies address tech debt and accelerate software delivery. Code assistants translate legacy code to newer languages, using natural language prompts, and support developers by debugging and creating tests.

Westpac has trained 800 engineers on the use of GAI tools to speed up software development, helping them to write 22% more lines of code per day. Westpac engineers are working with partners in the field of AI to create guardrails to help steer the use of the technology, as well as collaborating with universities and the tech industry to develop new AI-driven tools. Westpac CTO David Walker expects 2024 will see a further evolution of “intelligent banking”, incorporating AI to enhance the customer experience with new products and services.

Goldman Sachs is harnessing GAI internally to assist its developers in code writing. This initiative, still in the proof-of-concept stage, is a part of the bank’s broader strategy to integrate technology into its operations, potentially reshaping its approach to software development and financial services. In some cases, developers have been able to write as much as 40% of their code automatically using GAI, using the software to both test code and generate new code.

By mid-April 2024, Citi intends to deploy GitHub Copilot across its entire developer workforce consisting of 40,000 employees. This is expected to significantly reduce time, particularly in instances where developers can utilize reusable code from the bank’s own repository.

Source: 2024 Global Outlook for Banking and Financial Markets Regenerate banking with AI, IBM Institute for Business Value | Expert Insights

As illustrated by pioneering implementations the potential applications and benefits of GAI are vast and varied. However, the integration of GAI into banking is accompanied by a set of challenges that require meticulous management, including the navigation of emerging risks and the allocation of resources towards responsible implementation.

The focus must remain on leveraging GAI’s capabilities to enhance customer experiences, streamline operations, and secure a competitive edge in the rapidly evolving digital landscape. The promise of generative AI in banking is big, but its full realization will depend on the industry’s ability to adapt, innovate, and responsibly harness the technology.

Victoria Helin holds the position of Data Analyst at TreasurUp with proficiencies in Power BI, SQL, and Python. She is adept at using data analysis and insights to enhance banks’ understanding of their corporate customers’ requirements. Victoria finds great satisfaction in leveraging her analytical skills and technical expertise to extract meaningful insights from data, which in turn, drives the success of both the banks and their clients.

We are a Dutch FinTech company that provides banks around the world with innovative online front-end solutions for their business clients. These solutions are tailored to and designed for the bank, white-labeled and offered through Web, Mobile and APIs.

We offer solutions for bank business clients in the areas of:

We believe in a bank & fintech partnership model and are proud to have clients like Nordea, Rabobank, KBC, OP bank, SEB, Handelsbanken, OLB, Sparkasse and LBBW.

For more information about our tailored solutions for bank business clients please feel free to reach out: Request a Demo here.