Liquidity has many faces. Banks offer solutions with operational benefits for their Business clients, traded instruments ranging from Deposits, FX spot and Swaps and Money Market Funds to a variety of data and technology-driven solutions like deposit triggers used in retail banking. The business segment is the perfect spot to combine the easy-to-implement and operationally efficient Liquidity innovations from retail as well as the optimization techniques used by the larger corporates.

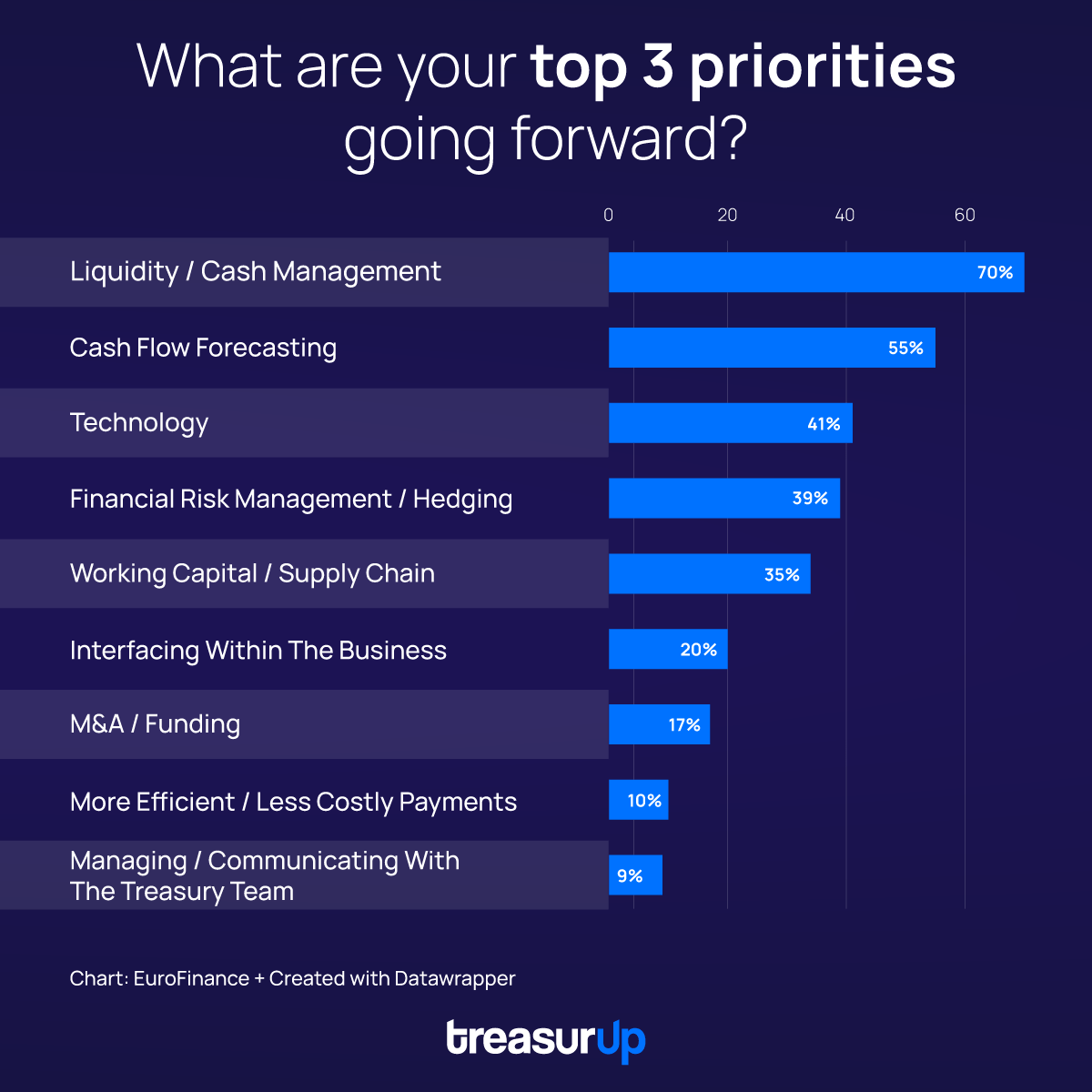

Liquidity/Cash Management, Cash Flow Forecasting (CFF) and technology are the Top 3 Treasurer’s Priorities According to Eurofinance. This survey answers the ‘what’-question and in this article we aim to answer the ‘question and how banks can partner with their Business clients’ Liquidity. Below we will go into more detail about the different levels of how banks can transform and professionalize the way their clients perform Liquidity Management activities and how this benefits the players.

Source: EuroFinance

Companies can have different targets and ways to operate but almost all companies require some form of Liquidity Management in order to be able to pay their bills and salaries and avoid legal issues linked to non-payment. We distinguish between two levels of Liquidity Management: Insights and Optimization. The first level of Liquidity Management – Insights – is all about providing the right people within a company with the latest information on which cash components the company has in terms of:

Cash balances per:

Historical insights and the ability to check cash drivers and individual debits and credits of the accounts.

The second level – Optimization – where a more robust foundation and processes are required to manage risk versus reward and operational work spent. It relates to where in the company which cash is needed and how to get the most out of the cash positions. This second level brings a range of benefits from an improved credit rating to higher profitability. That is why a sound company Liquidity Management can have a lot of positive impact on company financing and a company’s ability to execute its strategy. Most companies focus on financing costs (interest). There are a lot of reasons though to have a company’s finance or treasury department also look at metrics like forward points and return on deposits as they can be relevant for overall profitability.

Liquidity Management services are typically offered through the Cash Management department of a bank. On the other side, tradable Liquidity instruments are going through the Financial Markets side of the bank.

For businesses and medium-sized companies this creates a limitation in managing and optimizing Liquidity. In order to run a rather professional Liquidity Management program, the following elements are key:

All of this needs to be set up to match either a centralized or decentralized company structure. The main difference between the two is the company entity level at which execution takes place and the key personas involved.

Larger clients of banks often use a TMS with a rule-based liquidity engine. These TMSs have the elements mentioned above and are usually bank-agnostic. Most of the configuration is done by the corporate client but setup is cumbersome and usually requires external consultants and a long RFP trajectory. Especially for business clients the framework of self-service configuration and to a lesser extent being bank agnostic is appealing but the cost of implementing these TMS programs is usually considerable. Banks could play a role here.

Businesses that are growing well have a lot of potential for the banks. When companies grow they need to professionalize and doing this with a correct product fit not only gives the bank a more professional client but also opens a wider potential product portfolio.

We would like to share some relevant trends that have shaped new products and solutions.

The number of sustainable investment products has grown significantly. Not only retail clients of a bank but also business clients want to have a positive impact on society or even have to follow internal policies for investment objectives. Platforms have become much more transparent on risk vs return through which proper decision-making has become easier. API technology together with the right partners makes it possible to give the business direct insights into these factors as well as creating a plug and play, intelligent rule-based engine with dynamic updates on cash flow and other relevant metrics.

On the macro side interest rates are rising (of course they can also decline over time) and banks are potentially using deposits as funding. Instrument attractiveness varies with the macroeconomic circumstances. Therefore a holistic view across asset classes, (particularly Fixed Income, FX swaps and Money Market Funds) has become increasingly important for a bank’s treasury department. Banks either use their own balance sheet or suitable 3rd party liquidity providers.

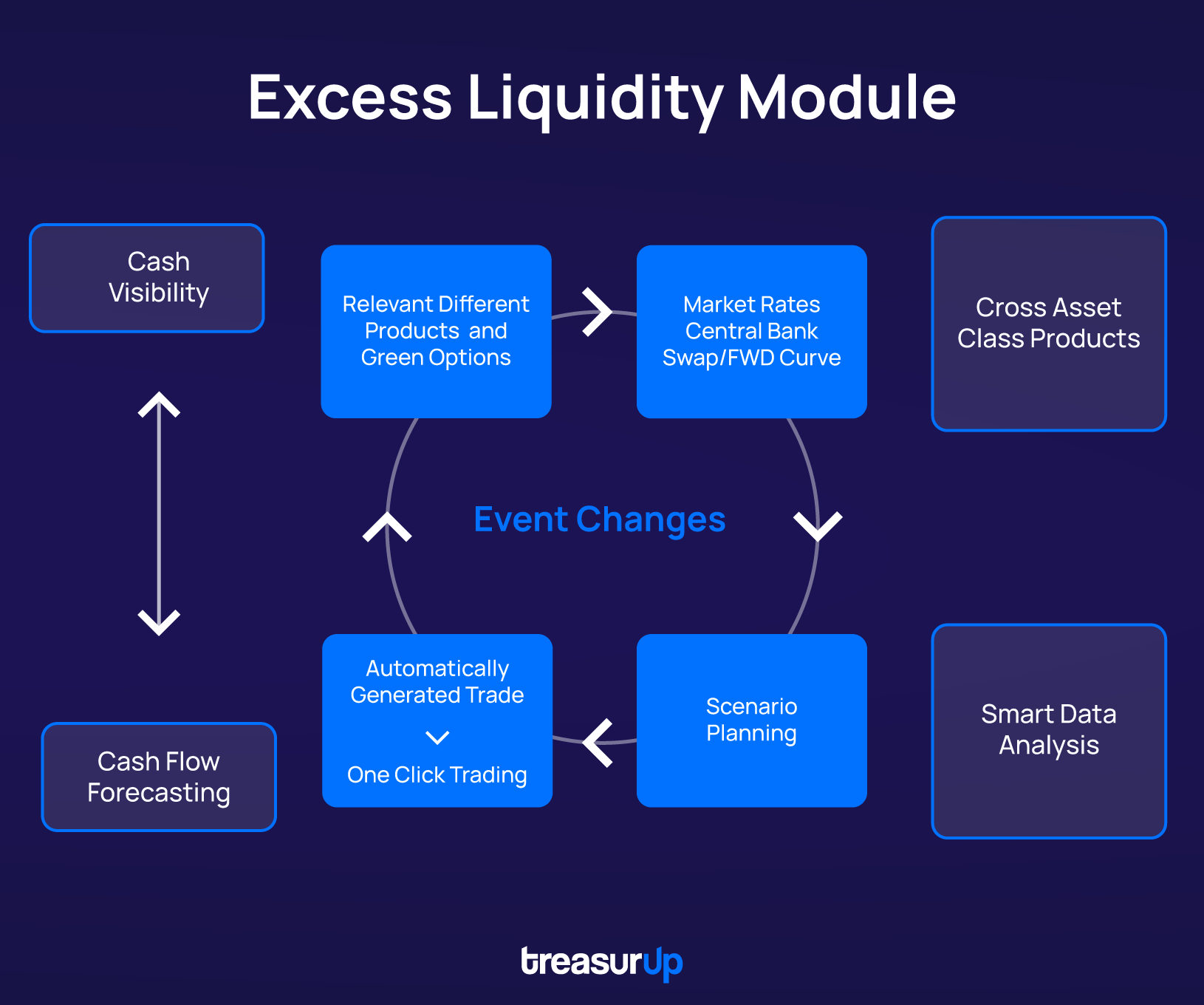

Larger corporations are usually very keen on having sound and auditable processes in place as well as having a focus on operational efficiencies and optimal financial behavior. Optimal here means using the best return at a low and measurable risk level. For treasurers of medium-sized companies, these optimization efforts can become impressive by using automation and ERP integration. The combination of intelligence for retrieving the right data set and a rule-based engine can create powerful execution, optimization and reporting capabilities. It is crucial that automated workflows are not a black box and that all data and event changes are auditable. Workflow – for example, approval hierarchies – is an absolute necessity for a proper Liquidity Management solution. It goes without saying that TreasurUp offers all of this.

Source: TreasurUp

The optimal liquidity solution for businesses brings together the ease of use of retail cases together with the optimization and compliance of the larger clients. At the start point of the journey, Cash Visibility should plug and play and be linked to different products and services depending on the complexities and goals of the company. This can be done by setting up a policy as a company where a rule-based engine is configured to make the task run efficiently.

The Borders between banks and clients are seamless, for example a smaller client might only need a combination of triggers from a historic cash balance showing how much and how long he can place a basic one-click deposit. A cross-journey between Cash Visibility and Markets would be this easy and accessible.

A medium-sized client might want to look at a Cash Flow Forecast to derive amounts and tenors and have multiple products and scenario planning before execution across the Markets and Cash Management departments of the bank.

From a workflow perspective, the ideal solution not only provides plug and play setup of all relevant insights, and dynamic updates on event changes but also easy-to-understand reporting capabilities and management information. The company’s Cash Flow will also be accurate and up-to-date resulting in solid and professional clients without cumbersome operational tasks.

Liquidity Management is crucial to banks as well as their customers. However many of the activities taking place are rule-based activities in the minds of those who execute and a mystery to many others.

The goals of Liquidity Management can range from ad hoc ensuring sufficient funds through efficient operational handling to optimizing but easy-to-set-up and use data set combined with transparent intelligence allowing banks to provide a solution that can benefit customers of all sizes. The call to action is to align what these clients need to achieve their goals with a bank-provided digital solution raising the bar for business Liquidity Management.

TreasurUpdate for Banks is TreasurUp’s monthly newsletter which keeps you up-to-date with the latest insights, knowledge, market trends, innovation, and new technologies related to online Commercial Banking.

As a FinTech that challenges the status quo in Commercial Banking, TreasurUp is committed to staying ahead of the curve and keeping up with the latest trends and technologies in Online Commercial Banking.

Niki van Zanten is TreasurUp’s Treasury Innovation Consultant with more than 20 years of experience in Corporate Treasury with a focus on Foreign Exchange. He has had previous roles as Director of financial risk at Philips Lighting and Foreign Exchange and Cash Management roles at Cisco Systems.

His role in TreasurUp is to ensure that all stakeholders, banks, end users, and technology providers designate and meet their goals together. His personal goal is to guide partners to a true financial ecosystem where banks have the right balance between open and in control.