In the dynamic landscape of cross-border payments, the call for bank modernization has become more pressing than ever. The burgeoning growth and unprecedented opportunities in the sector over the next 5-10 years beckon financial institutions to adapt and evolve. As the marketplace witnesses the emergence of a diverse array of players, it is timely to reflect on what new entrants bring to the table that traditional incumbents are yet to deliver, as well as the deeper ecosystem changes looming that are likely to displace traditional roles and legacy technologies.

Growth in the market has been relentless, with a revenue pot of an estimated $240 Billion in 2022 and 10% growth annualized in the commercial customer segment. Banks and their emerging competitors have plenty of motivation to ensure they hold on to or extend the volume of cross-border payments they facilitate for clients.

The shift to online transactions is not just a trend but a paradigm shift. Identifying and capitalizing on the competitive strategy deployed by players stepping in to capture these flows is pivotal. This shift is as relevant for Business-to-Business (B2B) transactions in the future as it is for current retail or Customer-to-Business (C2B) interactions. In the C2B space, PAYPAL, Adyen, Square and Stripe have stepped in front of the Banks and Card Networks to capture FX Revenues in the Billions. Rest assured the B2B segment is clearly in their sights.

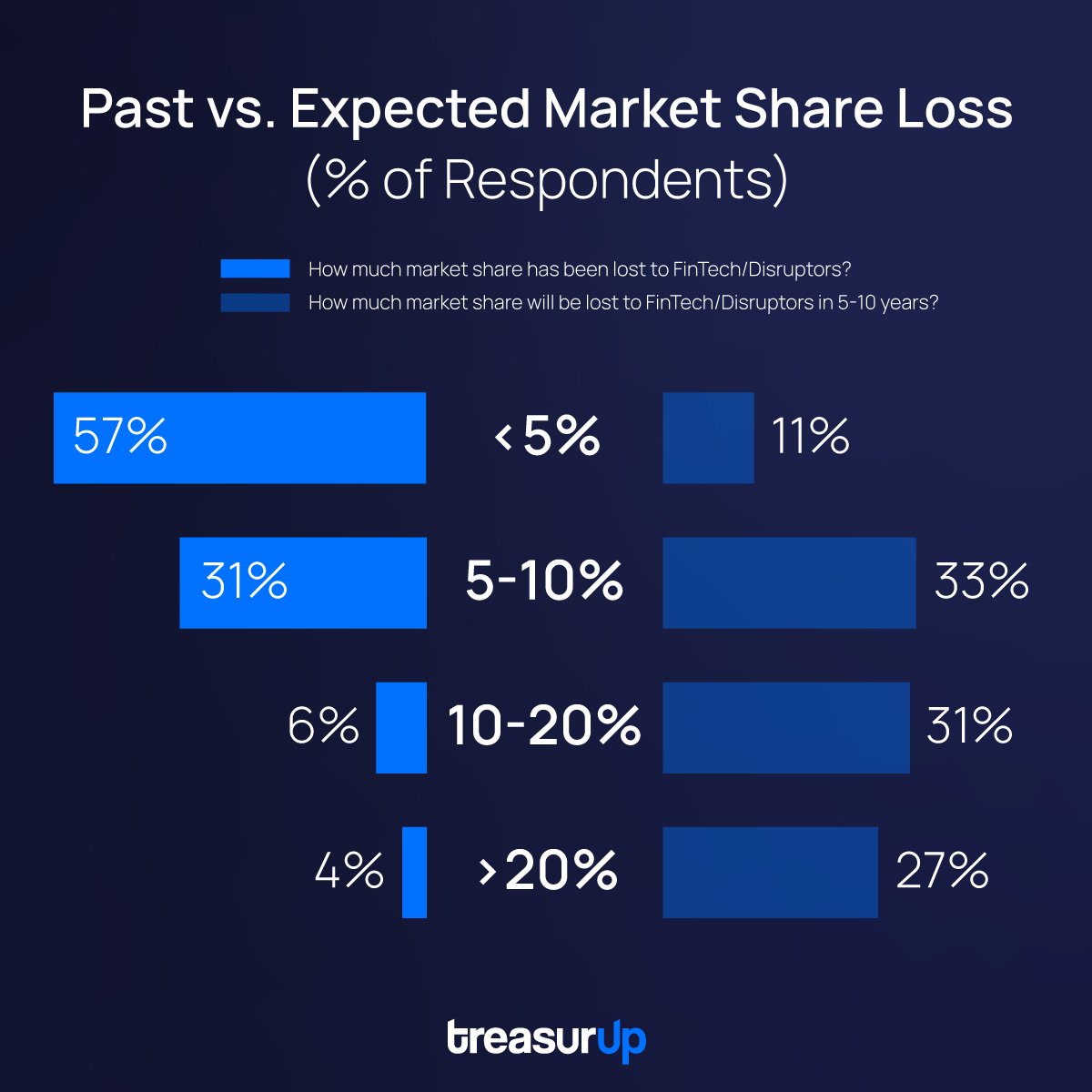

Figure 1: A neat perspective from Citibank Global Perspectives & Solution September 2023 edition, sums up current and forward looking shifts in market share between Banks and the Fintech disruptors.

Figure 1: (Expected) Impact for banks due to new players in Cross-Border Payments

Corporate clients are particularly sensitive to transparency, speed and cost, which directly translate to Payment Tracking, Certainty of Delivery (Trust and Security) and FX Rates combined with fees. While some of this can be delivered through UI/UX initiatives, the entire process chain that supports the orchestration of payment requires modernisation in order to match or exceed best-in-class solutions.

A seamless, multi-channel experience where customers can control and review payment flow is necessary in an increasingly mobile world. Managers should be able to approve or interact with transactions when on the road if required. API connections can enable a large degree of automation, pulling data from ERP platforms and highlighting entries that require repair or special handling before they generate a reconciliation item. Functional gaps that Fintechs and a subset of banks have solved but remain prevalent in the market include;

SME FX Market Share and the split between Banks and Brokers (NBFIs) are heavily competed. In some regions, this can be as much as 50%. The main trade-off driving this trend is ease of use (Superior UX or flexible API), price transparency & service. Compared to the trust that is assigned to passing a payment through a bank’s hands. If a bank can modernize Digital solutions to match the service levels of this emergent competition, they will go a long way towards attracting back clients.

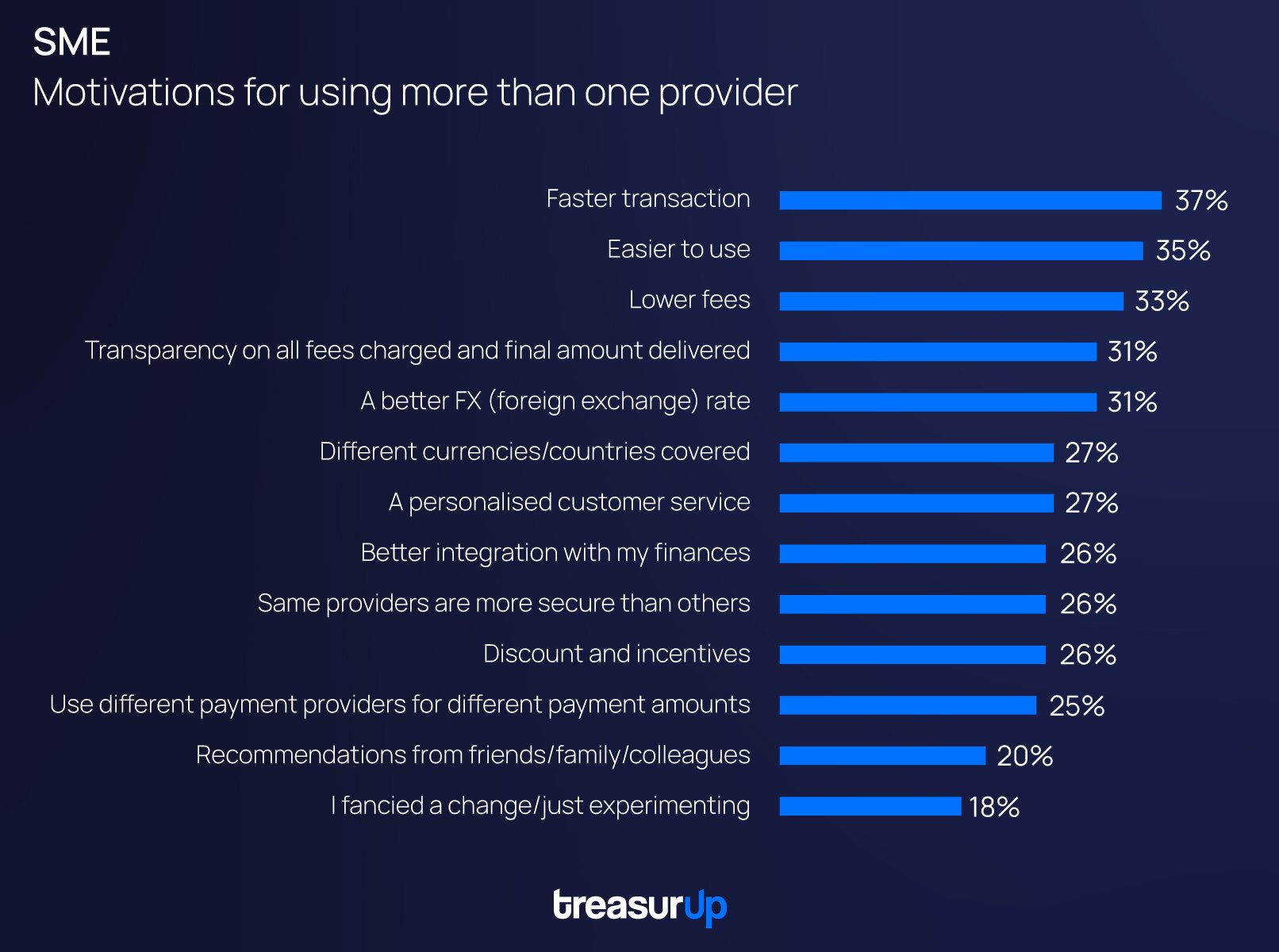

SMEs cite “the user experience” as the main driver for change after leaving a bank for a Fintech. In the survey results below, it’s apparent that FX Rates and Fees have less of an impact than ease of use, speed and transparency. Clients in Germany and Australia are looking around for embedded solutions that enable transaction processing through core processes.

Figure 2: July 2023 SWIFT report on capturing growth in low-value cross-border payments

Figure 2: SWIFT report July 2023

Virtual Assistants may bring some economies of scale into the training and education required for this segment to become self-sufficient. As a client segment, SMEs represent a valuable source of funding or liquidity for banks and will naturally allocate more business to the firms that provide them with the best combination of transaction services and decision support.

Intuitively, most business leaders understand there is value in collating, analyzing and presenting insights from data drawn from payment histories back to clients. Assigning the correct context to it based on industry segment is hard, without a deep understanding of the underlying business. Privacy laws are a roadblock to many of the potential use cases (benchmarking, peer analysis) that have been raised over recent years. For now, just making it easy for a customer to access, extract and model their data is a minimum requirement. Feeding this into cash flow forecasts (particularly for B2C enterprises) can help a corporate client manage liquidity more effectively or gain a clearer picture of trends shaping their business.

The landscape is evolving beyond traditional SWIFT mechanisms. Offering a full breadth of options around payment rails is crucial, naturally ISO 20022 plays a large part, as the standardized & richer data set enables easier implementation of ancillary processes around fraud, suspicious transactions or downstream data services. It also serves as a foundation step required to move onto blockchain or DLT. Some platforms already bypass Swift for low-value payments while ensuring the full breadth of Swift capabilities is enabled for higher-value transactions.

The capability that enables beneficiary validation and real-time status of payment will soon be universal as fraud liability resides with the bank should they fail to support this functionality soon (PSD3). The sophistication and speed associated with real-time domestic payments are now extending to cross-border flows. Already we can see in the wholesale FX market, that change is being driven by firms like Baton Systems delivering close to real-time clearing and settlement through the DLT-enabled Core-Fx module. Partior is another that is tapping into the technology, founded by JPM, Temasek, DBS and now Standard Chartered. It is working on Atomic settlement for intra-day Swap Liquidity, a step change in the flexibility that market participants need to reduce the cost of mitigating short-term funding risks.

Security and compliance are non-negotiable in the financial realm. Modern banks must leverage technology to automate connections through Anti-Money Laundering (AML) and sanctions screening processes, ensuring the integrity and legality of every transaction.

Historically, data derived from payment flows has been instrumental in optimizing marketing and timing of advertising efforts. Looking ahead, the focus will shift towards more automated allocation of trade or working capital finance. This deeper understanding of cash flow will enable more accurate pricing of debt solutions and allocation of credit.

As Central Bank Digital Currencies (CBDCs) gain prominence, banks must navigate the integration of these assets into an ecosystem traditionally dominated by fiat currency. In the absence of a crystal ball, bridging this gap will require a forward-thinking approach to maintain stability and efficiency in the financial system.

There is much hype and anticipation around how CBDCs have the potential to enable atomic settlement (simultaneous transfer of assets without the need for an intermediary) and this may well be the case with domestic payments. But when considered from a cross-border perspective, you still need an intermediary of some sort to take on the risk management role. Whether that is through the Fiat ecosystem or some kind of token or stablecoin and a transfer between digital wallets instead of accounts, I imagine there will be a bid/offer spread and a return for the risk facilitator that could result in a net reduction of costs for many. We are not there yet, but GAS fees will probably generate greater focus in the operations department than correspondent banking fees in only a few years.

While stablecoins provide a gateway from the VISA and Mastercard Networks into the “crypto” sphere, will they be displaced by the Central Bank alternatives?

How does the rapid acceleration of transaction and settlement times play into the need to monitor and control for Fraud and Sanctions? Will there be a continuous process running over the top of all Digital Wallets, locking and blocking bad actors as they are identified? Does the emergence of Quantum computing blow what we are considering today back to obsolescence in 5 -10 years?

The modernization of payment capabilities is not just an option but an imperative for banks aiming to thrive in the evolving financial landscape. Embracing innovation and delivering into a far more competitive market, will not only preserve customer connections but also position banks as leaders in the future, where accelerating the speed, increasing security and lowering the cost to deliver are central to success.

James Dalton our Asia-Pacific based Relationship Manager at TreasurUp, with over 20 years of global experience in Foreign Exchange Sales, Trading and Technology. James is the driving force behind TreasurUp’s strategic approach to accelerating the Bank proposition for revolutionizing cross-border payments.

If you are interested in exploring these themes further with James, please request a demo here.

TreasurUpdate for Banks is TreasurUp’s monthly newsletter which keeps you up-to-date with the latest insights, knowledge, market trends, innovation, and new technologies related to online Commercial Banking.

As a FinTech that challenges the status quo in Commercial Banking, TreasurUp is committed to staying ahead of the curve and keeping up with the latest trends and technologies.