Data analytics is transforming the world of banking, enabling financial institutions to gain a deeper understanding of their operations, identify trends and patterns in large datasets and make more informed decisions.

➡️ Click Here and Subscribe to our Monthly LinkedIn Newsletter ‘TreasurUpdate for Banks’

McKinsey reports that only 7% of banks are completely utilizing crucial analytics and states in their Global Banking Annual Review 2022 that banks can do a lot more to leverage their data. By leveraging the power of data analytics, banks can drive more successful outcomes and remain competitive in an increasingly challenging business environment.

In recent years, the use of advanced analytics has become increasingly common in the financial industry, as more and more banks turn to data-driven decision making to stay competitive. Data analytics is the process of analyzing and interpreting large and complex datasets in order to uncover insights and trends. Furthermore it is playing an increasingly important role in the banking industry, enabling banks and financial institutions to gain a deeper understanding of their operations, identify trends and patterns in large datasets, and based on that make more informed and accurate decisions.

Allied Market Research Data Analytics in Banking Market report estimates that the global data analytics in the banking market will increase from $4.93 billion in 2021 to $28.11 billion by 2031, expanding at a CAGR of 19.4% over the time period. The availability of insights is continually improved by the development of new technology. Furthermore, new trends continue to develop within analytics in the banking and finance sector.

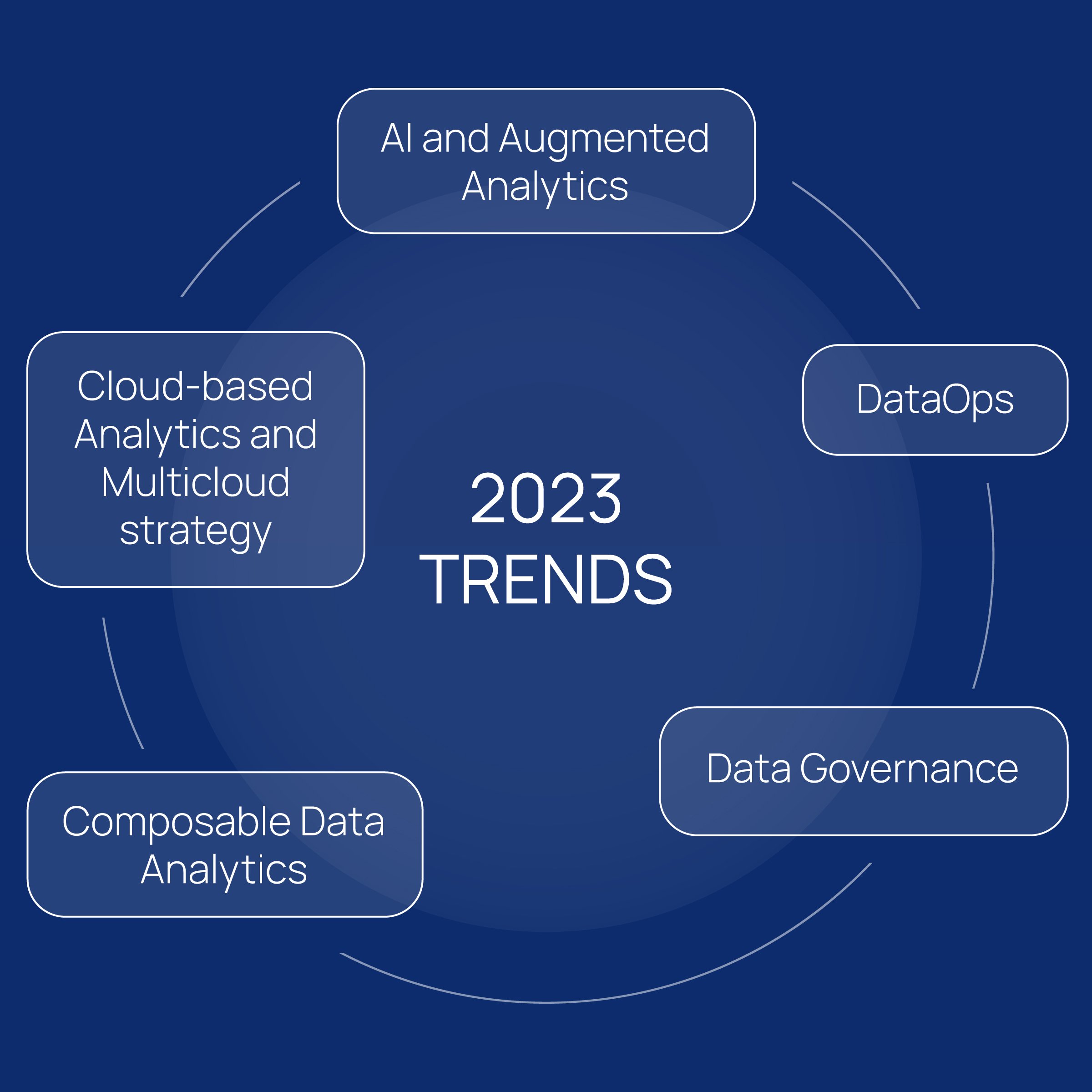

The world of analytics and data is constantly evolving and technologies that provide quicker and more accurate access to information are continually being developed. To maintain their competitiveness, banks must remain up to date with the recent analytics trends. This article describes the key trends in data analytics and banking in 2023; ‘AI and Augmented Analytics’, ‘DataOps’, ‘Data Governance’, ‘Composable Data Analytics’ and ‘Cloud-based Analytics and the Multicloud strategy’.

One of the major analytics trends in the banking and financial industry is the increasing use of artificial intelligence (AI) and machine learning (ML) algorithms. In the coming year, financial leaders anticipate adopting predictive analytics (42%), artificial intelligence (30%) and machine learning (26%) more frequently, according to Syntellis ‘2022 CFO Outlook for Financial Institutions’ report. The use of AI in analytics is transforming the field of finance, enabling organizations to make more informed and accurate decisions.

Augmented data analytics is a term used to describe the use of artificial intelligence (AI) and machine learning (ML) technologies to enhance traditional data analytics in the banking and finance industry. It involves the integration of these technologies into existing data analytics systems, providing more accurate and timely insights that can inform business decisions. Gartner predicts that by 2023, augmented data management will lessen the need for financial analysts for repetitive and regular data management duties, saving up to 20% of their time for collaboration, training, and high-value analytics tasks.

One of the main benefits of augmented data analytics in banking and finance is the ability to quickly and accurately analyze large amounts of data. With traditional data analytics systems, this can be a time-consuming and error-prone process, as it requires manual sorting and analysis of data. By using AI and ML technologies, banks and financial institutions can quickly and accurately identify trends and patterns in data, providing them with valuable insights so that they are better informed and can act on business decisions in the most effective way.

DataOps, or Data Operations, is a relatively new trend in the banking industry that aims to improve the efficiency and effectiveness of data management and analysis, as well as enable the development of new data-driven products and services. It is the practice of integrating data management and data engineering with software development and delivery processes.

In the banking and finance industry, DataOps can play a crucial role in processing large volumes of data from various sources, such as customer transactions and market data, and ensuring that data is accurate, consistent, and compliant with relevant regulations. Forbes estimates that during 2023, data-centric businesses will require their DevOps teams to collaborate with data scientists and engineers to develop the organizational structures, business processes, and tools that will support the data business unit. McKinsey states that 80% of organizations spend their time on repetitive procedures like data preparation in analytics initiatives, and that only 10% of businesses feel they have this problem under control. With the increasing importance of data-driven decision making, many banks have initiated heavy investments in DataOps as a way to improve their performance and better serve their customers.

Another trend in analytics in finance is the growing importance of data governance. Data governance is the process of establishing and maintaining control over the collection, storage, use, and dissemination of data within an organization. It is a critical component of any successful data management strategy, and is essential for ensuring the accuracy, integrity, and security of an organization’s data assets.

As more countries pass legislation intended to control the use of personal and other sorts of data, data governance will continue to be an important topic in 2023. Other nations are likely to enact legislation protecting their residents’ data in the wake of examples like the European GDPR, Canadian PIPEDA, and Chinese PIPL. In fact, Gartner forecasts that by 2023, GDPR-like rules will apply to 65% of the world’s population. Banks and financial institutions are therefore investing in data governance systems and processes to help them manage and control their data assets more effectively.

Capgemini is reporting that the financial services sector is evolving toward enforceable data governance, which transforms static policies and norms in Word documents into governance processes that may be realized in IT and the business with real advantages. The most important governance objective for banks and financial services companies is the accessibility of trustworthy and accurate data for risk aggregation and reporting, including data accountability and traceability.

Composable data analytics is a new approach to data analysis that allows users to easily combine different data sources and analysis methods to create complex data analytics pipelines. This approach is particularly useful for organizations that have large and varied datasets, as it allows them to quickly and easily combine different data sources and analysis methods to answer specific business questions. Composable analytics can also lower data center expenses. With composable data analytics, a company’s data center expenses will be lower even if it migrates to the cloud.

According to Gartner analysts, by 2023, 60% of firms will combine elements from three or more analytics solutions to create business apps that integrate data and link insights to actions. In the banking industry, composable analytics can be particularly useful for data analytics because of the large and diverse nature of the data that banks typically handle. Banks often deal with a wide range of data types, including financial transactions, customer data, market trends, and regulatory requirements. This data can come from a variety of sources, including internal systems, external partners, and public datasets. By using modular components, analysts can easily connect their data pipelines to other tools and systems, such as data visualization tools or machine learning models. This allows analysts to easily incorporate their work into larger data analysis projects, and to collaborate with other analysts and data scientists in order to gain new insights from their data.

The fifth trend in analytics in finance is the rise of cloud-based analytics platforms. Cloud-based analytics is the use of cloud computing technologies to store and analyze large amounts of data. It allows organizations to store, process, and analyze data in the cloud, rather than on-premises, providing them with greater flexibility and scalability.

Financial institutions now significantly rely on big IT companies’ cloud computing and data analytics services as part of their digitalization strategies. Using cloud-based technologies, banks and financial institutions can lower operating costs while boosting efficiency and improving customer experience. A survey commissioned by Google Cloud conducted on decision-makers in the financial sector in North America, Europe, and Asia-Pacific revealed that 83% of respondents are already utilizing public clouds in some capacity. The same survey revealed that 17% of financial institutions use a multicloud strategy. Notably, the majority of companies, 88%, that do not already use a multicloud strategy are considering doing so in the near future. These platforms enable financial institutions to store and analyze large amounts of data in the cloud, providing them with greater flexibility and scalability than traditional on-premises analytics systems. By using cloud-based analytics platforms, banks and financial institutions can gain real-time insights into their operations, and make faster, more informed decisions.

Data democratization is the process of making data easily accessible and understandable to all members of an organization, regardless of their technical expertise or job function. TreasurUp’s data services perform data consultancy for banks and collection, cleaning and visualization of the data to help the banks draw conclusions of their clients trading behaviour and usage of TreasurUp’s hedging products. TreasurUp is combining different analytics tools, in agreement with the bank, to collect different types of data. Examples of this are trading data and changes in trading behaviour, user session activity, heatmaps, user journey recordings and satisfaction scores on the web and mobile application that helps the banks understand their customers even better.

Overall, the use of analytics in the banking and finance sector is on the rise, and is set to continue growing in the coming years. According to McKinsey, improving analytics efforts might boost global banking industry profits by as much as $1 trillion yearly. As more data becomes available, and as FinTech companies like TreasurUp continue to push the boundaries of innovation, the use of analytics will become increasingly important for banks looking to stay competitive in the fast-paced world of finance.

➡️ Click Here and Subscribe to our Monthly LinkedIn Newsletter ‘TreasurUpdate for Banks’

Victoria Helin is TreasurUp’s Data Analyst working with Power BI, Tableau, Metabase, SQL, R and Python. She specializes in using data insights and analysis to assist banks in better understanding the demands of their corporate customers. Victoria is highly skilled in analyzing large datasets to identify trends and patterns and effectively communicate the findings to both technical and non-technical stakeholders. For Victoria, the most rewarding part of her work is utilizing analytical and technical skills to extract valuable insights from data that contributes to driving business success for the bank and their customers.

Stay updated on the latest in online Commercial Banking, and subscribe to our monthly LinkedIn Newsletter “TreasurUpdate for Banks.”