Welcome to our latest newsletter, where we discuss the potential of Artificial Intelligence (AI) to transform Commercial Banking. As AI continues to evolve, it can reshape traditional banking, offering new possibilities and opportunities for growth. In this edition, we consider the role of AI in Commercial Banking, its future, and its applications in banking.

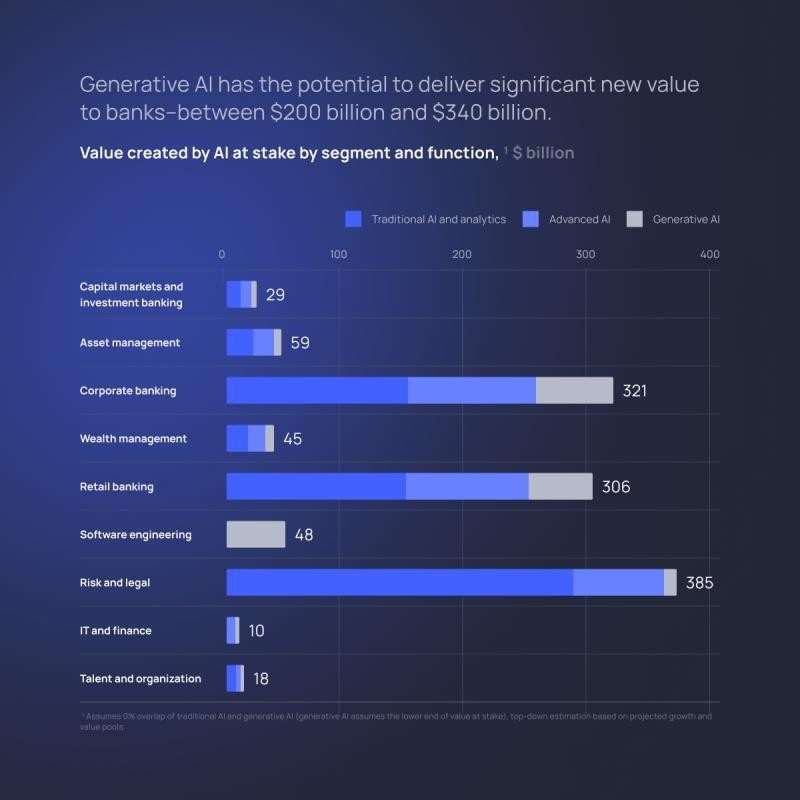

For years, traditional AI has been used in Commercial Banking, helping with fraud detection, risk management and making operations smoother. Banks have used AI to spot unusual transaction patterns, assess credit risks, and handle tasks like verifying documents and ensuring compliance. These AI applications have made banking safer, more accurate, and more efficient. But now, things are changing with the rise of Generative AI. This new technology promises even more advanced and flexible uses in the banking world. McKinsey & Company (2023) estimates that Generative AI has the potential to deliver between $200 billion and $340 billion of new value to banks.

The main difference between traditional AI and Generative AI lies in their capabilities and applications. Traditional AI, often rule-based and predictive, excels at analyzing data, identifying patterns, and automating routine tasks. It’s great for improving efficiency and accuracy in well-defined areas.

On the other hand, Generative AI can create new content and provide deeper insights by understanding and generating human-like content. But what exactly can be the applications of Generative AI in Commercial Banking?

Generative AI is opening up a whole range of new possibilities in Commercial Banking. Some use cases include:

1) Client Relations: By integrating multiple data sources with Generative AI, the bank can generate a comprehensive overview of a client’s pain points and opportunities. This enables relationship managers to better prepare for client meetings and offer more tailored, insightful advice.

2) Customer Support: Advanced chatbots and virtual assistants powered by Generative AI can handle complex customer questions, provide instant support, and resolve issues quickly. This improves customer satisfaction and reduces the workload on human support teams.

3) Personalized Marketing: Generative AI can analyze customer data to create highly personalized marketing campaigns. By recommending products and services tailored to individual client needs and preferences, banks can increase engagement and conversion rates.

4) Risk Assessment and Management: Generative AI can simulate various market scenarios and their impacts on clients’ portfolios. This helps banks to better assess and manage risks, leading to more informed decision-making in lending and investment.

5) Product Development: AI can analyze customer feedback and market data to generate innovative ideas for new banking products and services. This helps banks to better meet client needs and maintain a competitive edge.

6) Business Intelligence On-Demand: Generative AI can enable clients to ask complex questions about their data and receive insightful answers. This capability allows clients to make more informed decisions based on their data within the bank’s offerings. For a preview of this potential, try asking ChatGPT a question about one of your Excel files (without sensitive information). This use case holds significant promise for enhancing business intelligence capabilities.

These examples illustrate just a few of the immediate applications of Generative AI in Commercial Banking. There are many more potential uses, some of which will become clearer as the technology continues to evolve, some of these we will discuss during our upcoming webinar (more info below), where we will go deeper into these topics and explore the future of AI in Commercial Banking with industry experts.

While Generative AI offers significant potential, it also comes with notable risks. One of the primary concerns is its non-deterministic nature, meaning the outputs can be unpredictable and vary each time the AI responds. This unpredictability can lead to inconsistencies in customer interactions, potential compliance issues, and unintended biases in decision-making processes.

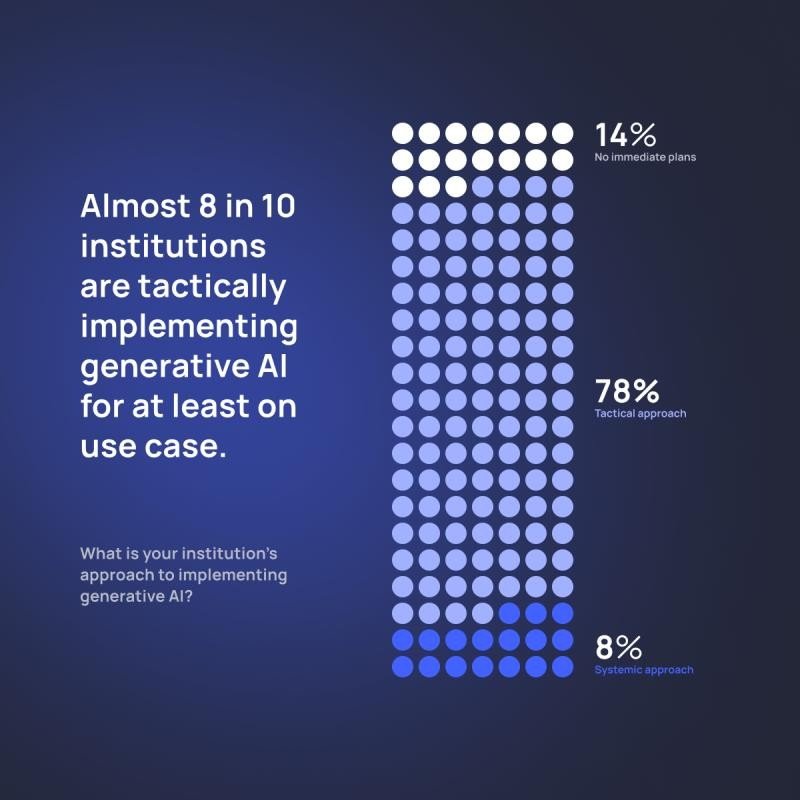

So, should banks refrain from using Generative AI? Definitely not. The best approach is to start on a limited scale, gain valuable experience, and position your bank at the forefront of this exciting new technology. By doing so, banks can harness the benefits while managing risks effectively, ensuring they remain competitive in an evolving landscape.

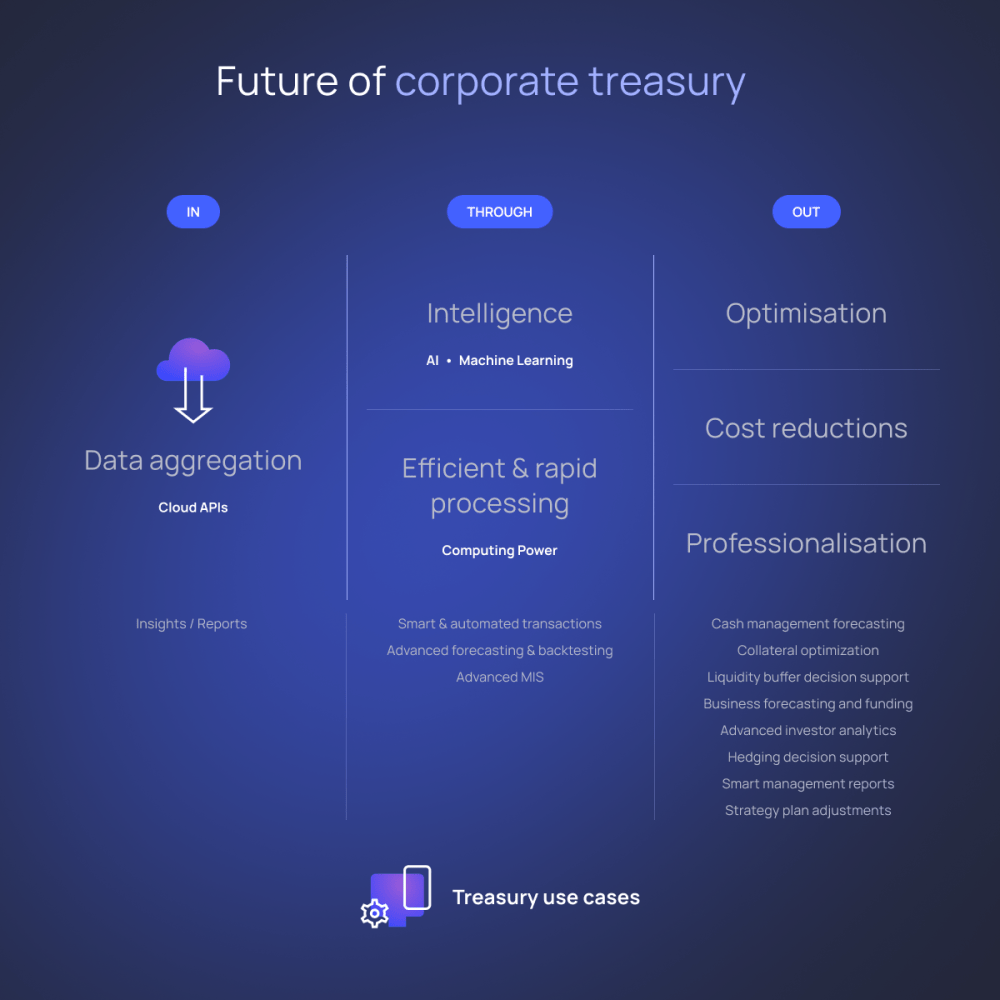

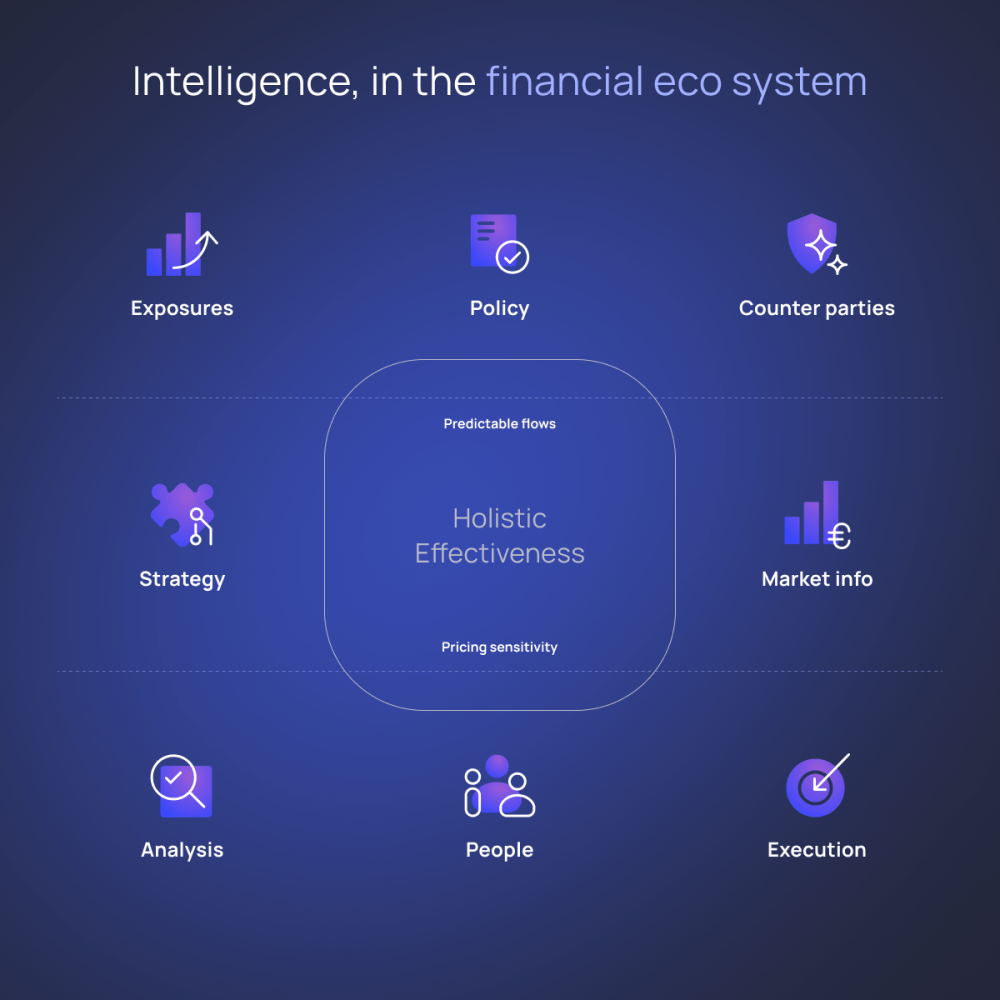

AI is rapidly transforming Commercial Banking, offering numerous benefits from enhanced customer service to improved risk management. As we move forward, the integration of AI in banking will continue to evolve, driven by advancements in AI and other technologies.

Don’t miss this opportunity to explore the future of Commercial Banking in the era of AI contact us now.

References: